Did you know that it takes an average of 10 minutes to mine one Bitcoin? However, the reality is that not everyone can afford the necessary equipment, resulting in elongated mining periods that can stretch up to 30 days for most users. Additionally, the cost of mining Bitcoin can be substantial, with estimates suggesting it could cost up to $73,000 depending on local electricity rates. In this article, we will delve into the hidden costs and implications of Bitcoin mining, shedding light on this resource-intensive process.

Table of Contents

ToggleKey Takeaways

- Mining Bitcoin requires ideal hardware and software, which can be expensive and not affordable for everyone.

- The mining process is time-consuming and resource-intensive, taking an average of 30 days to mine one Bitcoin.

- Electricity costs are a significant factor in the overall expense of mining, and it could cost up to $73,000 to mine one Bitcoin, depending on electricity costs.

- Joining a mining pool allows miners to share the costs and rewards, reducing the time and resources required to mine a Bitcoin.

Average Mining Time for One Bitcoin

The average mining time for one Bitcoin is a crucial factor to consider when assessing the hidden costs of Bitcoin mining. Bitcoin mining efficiency and the impact of mining difficulty play a significant role in determining this time frame. Bitcoin mining efficiency refers to the ability of mining hardware to solve complex mathematical problems and validate transactions with minimal energy consumption. As mining difficulty increases, the computational power required to mine each Bitcoin also increases. This results in longer mining times and higher energy consumption. The longer it takes to mine one Bitcoin, the more electricity is consumed, leading to higher operational costs. Therefore, it is essential for miners to optimize their hardware and software to improve efficiency and reduce the time it takes to mine one Bitcoin, ultimately mitigating the hidden costs associated with Bitcoin mining.

Necessary Hardware and Software

To successfully mine Bitcoin, miners must have the necessary hardware and software. Here are the key requirements for mining Bitcoin:

-

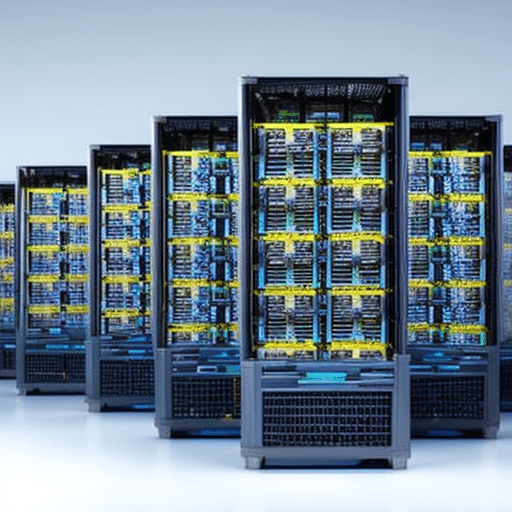

Cost of Mining Equipment: Mining Bitcoin requires specialized hardware known as ASIC (Application-Specific Integrated Circuit) miners. These machines are specifically designed to perform the complex calculations needed for mining. However, they come with a hefty price tag. The cost of mining equipment can range from a few hundred dollars to several thousand dollars, depending on the model and capabilities.

-

Software Requirements: In addition to the hardware, miners need mining software to connect their machines to the Bitcoin network. This software enables miners to communicate with other nodes on the network and participate in the mining process. Popular mining software includes CGMiner, BFGMiner, and EasyMiner, among others.

-

Power Supply: To operate the mining equipment, miners need a stable power supply. The power consumption of ASIC miners is significant, and miners must consider the electricity costs before embarking on the mining journey.

-

Cooling Systems: Mining equipment generates a substantial amount of heat during operation. To prevent overheating and ensure optimal performance, miners often invest in cooling systems such as fans or liquid cooling solutions.

Mining Bitcoin requires not only financial investment but also careful consideration of the hardware and software requirements. Miners must weigh the costs against the potential rewards to determine the feasibility of mining operations.

Cost of Equipment and Electricity

Mining Bitcoin incurs significant expenses, including the cost of equipment and electricity. The cost of equipment is a crucial factor in determining the profitability of Bitcoin mining. Specialized mining hardware, such as ASICs (Application-Specific Integrated Circuits), is required to efficiently mine Bitcoin. These devices are expensive and require a substantial upfront investment. Additionally, the cost of electricity plays a major role in the overall expense of mining. Bitcoin mining is an energy-intensive process, and the electricity consumption can be substantial. Miners need to consider the cost of electricity in their profitability analysis to ensure that their mining operations remain economically viable. High electricity costs can significantly impact the profitability of mining Bitcoin, and miners often seek locations with lower electricity rates to maximize their returns. Therefore, understanding and managing the cost of equipment and electricity are essential for successful Bitcoin mining operations.

Time and Resource Considerations

Time and resource management is crucial in the process of Bitcoin mining. Efficient mining requires careful consideration of various factors to optimize the use of time and resources. Here are some key considerations for efficient mining:

-

Hardware and Software Optimization: Choosing the right hardware and software is essential to maximize mining efficiency. Miners need high-performance equipment capable of handling the complex calculations involved in mining Bitcoin.

-

Electricity Consumption: The energy-intensive nature of Bitcoin mining presents challenges in resource management. Miners must carefully manage their electricity consumption to minimize costs and maximize profitability. This involves selecting energy-efficient hardware and finding locations with low electricity rates.

-

Cooling and Maintenance: As mining hardware generates significant heat, proper cooling systems are necessary to prevent overheating and ensure optimal performance. Regular maintenance is also crucial to prevent hardware failures and costly downtime.

-

Network Connectivity: Stable and reliable internet connectivity is essential for efficient mining. Miners need a solid connection to the Bitcoin network to participate in mining activities without interruptions.

Challenges in resource management can significantly impact the profitability of Bitcoin mining. Miners must carefully consider these factors to ensure efficient and cost-effective operations.

Benefits of Joining a Mining Pool

Joining a mining pool offers miners the opportunity to combine computational power and share in the rewards, reducing the time and resources required for efficient Bitcoin mining. Mining pools are formed by multiple miners pooling their resources, and each miner in the pool receives a portion of the mined Bitcoin. Participating in a mining pool has several advantages and disadvantages, as shown in the table below:

| Advantages | Disadvantages |

|---|---|

| Increased chances of finding a block | Lower individual rewards |

| Smoother and more consistent earnings | Dependence on pool’s management and trustworthiness |

| Reduced time and resources required | Potential for centralization and concentration of power |

Joining a mining pool is a popular option for miners with limited resources, as it allows them to have a more stable income stream and avoid the high costs of mining equipment and electricity. However, it also comes with the risk of relying on the pool’s management and potential centralization, which can impact the decentralization and security of the Bitcoin network. Miners should carefully consider these factors before deciding to join a mining pool.

Bitcoin’s Popularity and Impact

Bitcoin has gained significant popularity and recognition in recent years, impacting the world of finance and sparking widespread discussions about its potential. This surge in popularity can be attributed to several factors, including its decentralized nature, potential for high returns, and the increasing adoption of blockchain technology. However, along with its rise in popularity, Bitcoin has also raised concerns regarding its environmental impact and the need for government regulations.

- Bitcoin’s environmental impact: The process of mining Bitcoin requires a significant amount of computational power and energy consumption. This has led to concerns about the carbon footprint associated with Bitcoin mining and the increasing strain on energy resources.

- Government regulations on Bitcoin: As Bitcoin gains mainstream acceptance, governments around the world are grappling with the need to regulate this digital currency. The lack of centralized control and the potential for illicit activities have led to calls for stricter regulations to ensure consumer protection and financial stability.

As Bitcoin’s popularity continues to grow, it is crucial to address these concerns and strike a balance between innovation and responsible governance.

Importance of Understanding Blockchain Technology

Understanding blockchain technology is essential for comprehending the inner workings of cryptocurrencies and their potential impact on various industries. Blockchain is a decentralized digital ledger that ensures transparency and security in transactions. It offers numerous advantages, such as a decentralized ledger, which eliminates the need for intermediaries and enhances transparency. The security of blockchain technology is another key aspect. It utilizes cryptographic algorithms to secure data, making it nearly impossible to alter or tamper with. This level of security has attracted the attention of industries beyond finance, including supply chain management, healthcare, and voting systems. By understanding blockchain technology, individuals and businesses can harness its potential to revolutionize their respective fields, streamlining processes, enhancing security, and promoting trust among participants.

Frequently Asked Questions

What Are the Environmental Impacts of Bitcoin Mining?

Bitcoin mining has significant environmental impacts due to its high energy consumption and carbon footprint. The process requires powerful hardware and consumes a considerable amount of electricity, contributing to greenhouse gas emissions and environmental degradation.

How Does the Price of Bitcoin Affect the Profitability of Mining?

The profitability of mining Bitcoin is directly affected by the price of electricity and mining hardware costs. Higher electricity prices and expensive hardware can significantly impact the profitability of mining operations.

Are There Any Risks Associated With Participating in a Mining Pool?

Participating in a mining pool comes with some security risks and the potential for centralization. However, it remains a popular option for miners with limited resources as it reduces the time and resources required to mine Bitcoin.

Can Mining Bitcoin Be Done on a Regular Computer or Does It Require Specialized Equipment?

Mining Bitcoin requires specialized equipment known as ASIC miners, as regular computers lack the necessary computational power. These ASIC miners are designed specifically for Bitcoin mining and are essential for efficient and cost-effective mining operations. Additionally, the energy consumption in Bitcoin mining is a significant factor to consider.

How Does the Difficulty of Mining Bitcoin Change Over Time?

The difficulty of mining Bitcoin changes over time due to the mining algorithm’s efficiency. This impacts the transaction processing time, requiring miners to adapt their hardware and software to maintain optimal mining capabilities.