Choosing the right crypto wallets for beginners is essential for safely storing and managing digital assets. With the crypto market growing rapidly in 2025, having a secure, user-friendly wallet ensures your investments are protected while giving you easy access to trading and staking opportunities.

Key Takeaways

- Top beginner wallet: ZenGo offers keyless security with biometric authentication

- Most secure option: Ledger Nano S Plus provides affordable cold storage protection

- Mobile-friendly choice: Trust Wallet supports over 1 million digital assets

- Critical security practice: Always backup recovery phrases in multiple secure locations

- Latest industry trend: Self-custody solutions gaining popularity amid exchange vulnerabilities

Introduction: Why Choosing the Right Crypto Wallet Matters in 2025

The world of cryptocurrency has changed a lot by 2025. Now, more people are using digital assets. Choosing the right wallet is key to keeping your crypto safe.

Over 420 million people worldwide now own cryptocurrency, says the Chainalysis Market Report. First-time investors make up 22% of new wallet creations in the last six months. This shows how important it is to start with the right wallet. I’ve helped many beginners choose the best wallets for security and ease of use. This guide will help you pick the safest and most user-friendly crypto wallets for 2025.

What Exactly Is a Crypto Wallet?

A crypto wallet is more than a place to store your assets. It’s a tool that manages your keys. This lets you:

- Send and receive cryptocurrencies securely

- Interact with blockchain networks

- Access decentralized applications (dApps)

- View and manage your entire digital asset portfolio

- Verify and sign transactions

Crypto wallets give you direct control over your assets. They use private keys to prove your ownership on the blockchain. This changes how you see money, making you the owner of your wealth.

Understanding the Two Primary Wallet Categories

Crypto wallets are divided into two main types, each with its own security level:

1. Hot Wallets (Online)

- Software wallets: Desktop applications

- Mobile wallets: Smartphone apps

- Browser extensions: Web-based access

- Web wallets: Cloud-based solutions

Hot wallets stay connected to the internet. They’re easy to use but less secure. They’re more open to security risks.

2. Cold Wallets (Offline)

- Hardware wallets: Physical devices storing keys offline

- Paper wallets: Physical documents with keys

- Air-gapped systems: Computers never connected to the internet

Cold wallets keep your keys offline for maximum security. They’re the safest choice for big crypto investments.

Common Beginner Mistakes to Avoid

Working with new crypto users, I’ve seen many mistakes:

- Relying solely on exchange wallets: Exchanges like Coinbase or Binance offer easy wallet use but keep your private keys. Remember, “not your keys, not your coins” is a warning. Exchange hacks and failures have cost billions of dollars in lost funds.

- Neglecting recovery phrase backups: Your seed phrase is the key to all your wallet assets. Losing it without a backup means you’ll never get your money back. This mistake has cost users over $20 billion in lost Bitcoin.

- Falling victim to sophisticated phishing: Crypto users face more targeted attacks. In 2024, phishing scams pretending to be major wallets stole over $300 million in assets.

- Using weak security configurations: Not using extra security like two-factor authentication or biometric verification makes you more vulnerable.

Essential Features Beginners Should Prioritize in 2025

When choosing a crypto wallet, beginners should look for these key features. They should balance security with ease of use:

1. Intuitive User Experience

The best wallets for new users offer:

- Clean, easy-to-use interfaces

- Simple setup guides

- Clear transaction confirmations

- Visual balance displays

- Helpful educational resources

2. Comprehensive Asset Support

Look for wallets that support:

- Bitcoin and major cryptocurrencies

- Ethereum and ERC-20 tokens

- Multiple blockchain networks

- NFTs and digital collectibles

- Emerging assets you might want to explore

3. Robust Security Infrastructure

Essential security features include:

- Full private key ownership

- Strong encryption standards

- Optional biometric authentication

- Automated backup reminders

- Transaction verification screens

4. Responsive Customer Support

Quality support services provide:

- Multiple contact channels

- Comprehensive knowledge bases

- Active community forums

- Quick response times

- Clear security advisories

5. Seamless Ecosystem Integration

Valuable integrations include:

- Direct exchange access

- DeFi protocol connections

- NFT marketplace compatibility

- Fiat on/off ramps

- Web3 browser functionality

Top 5 Crypto Wallets for Beginners in 2025: Detailed Analysis

After thorough testing and security checks, these five wallets are the best for beginners in 2025:

1. ZenGo: Best for Absolute Beginners

ZenGo has changed wallet security with its keyless approach. It’s very beginner-friendly and still very secure.

Key Features:

- Uses MPC technology to eliminate seed phrases

- Facial biometric recovery system

- Built-in Web3 browser

- Supports 100+ cryptocurrencies including Bitcoin, Ethereum, and Solana

- Integrated earning and staking options

Security Highlights:

- No single point of failure with distributed key management

- Threshold signatures requiring multiple authentications

- Biometric verification for all transactions

- Automatic backup to encrypted cloud storage

User Experience: ZenGo shines with its simple interface and easy steps. It has a 4.8/5 user satisfaction rating on iOS and Android. Setup is quick, taking under 3 minutes with just basic info and biometric scanning.

Limitations:

- Not fully non-custodial in the traditional sense

- Limited advanced trading features

- Higher fees for some integrated services

Ideal For: First-time crypto users seeking maximum simplicity without compromising on essential security.

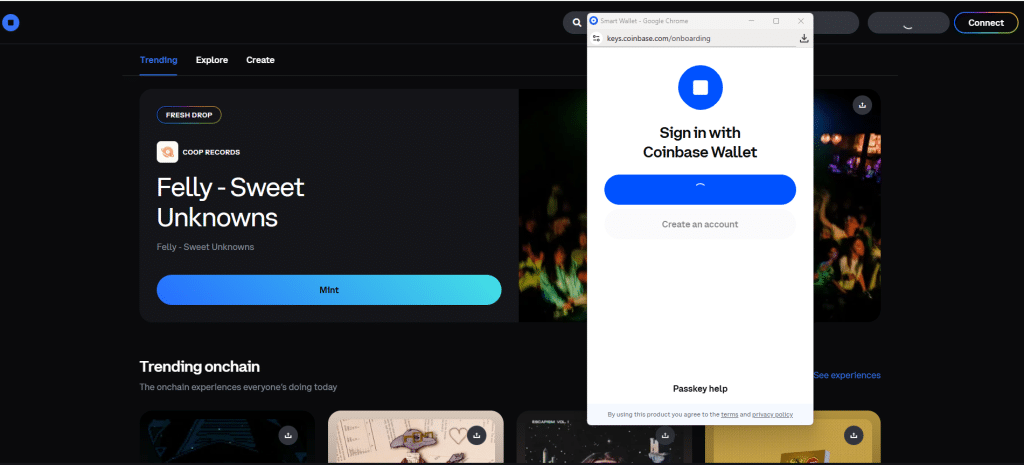

2. Coinbase Wallet: Best for Exchange Integration

This wallet is separate from Coinbase exchange but offers easy integration with America’s largest regulated platform.

Key Features:

- Full private key control

- Support for thousands of tokens across multiple networks

- Direct dApp browser access

- NFT gallery and management

- QR code and username-based transfers

Security Highlights:

- Secure enclave key storage on mobile devices

- Optional cloud backup encryption

- Connection to hardware wallets

- Detailed transaction approval screens

- Whitelisted address functionality

User Experience: The Coinbase Wallet has a clean interface and great tutorials. It’s easy to use, especially for those already on Coinbase Exchange.

Limitations:

- Some features encourage using the custodial Coinbase Exchange

- Transaction fees can be higher when using integrated services

- Customer support response times vary widely

Ideal For: Beginners already using Coinbase Exchange who want to maintain control of their private keys while keeping familiar interfaces.

3. Trust Wallet: Best Mobile-Focused Solution

Acquired by Binance in 2018, Trust Wallet is now a top mobile crypto management solution.

Key Features:

- Support for over 1 million digital assets

- Native staking for proof-of-stake coins

- Integrated DeFi platform access

- NFT collection display

- Fiat purchase options through partners

Security Highlights:

- Client-side encryption

- Locally stored private keys

- Optional biometric authentication

- Detailed permissions control for dApps

- Security notification system

User Experience: Trust Wallet is easy to set up and navigate. Its in-app browser makes exploring Web3 apps simple, even for beginners.

Limitations:

- Mobile-only approach limits desktop functionality

- Inherent security limitations of mobile environments

- Advanced features can overwhelm complete beginners

Ideal For: Mobile-centric users who want a comprehensive crypto solution in their pocket with direct access to decentralized applications.

4. Ledger Nano S Plus: Best Hardware Security for Beginners

The Ledger Nano S Plus is the most accessible entry into hardware wallet security. It balances protection with a reasonable cost.

Key Features:

- Physical isolation of private keys

- Support for 5,500+ cryptocurrencies and tokens

- Ledger Live companion app for management

- NFT support with clear visualization

- Optional recovery phrase verification

Security Highlights:

- Certified secure element chip (EAL5+)

- Completely air-gapped transaction signing

- Pin code protection with anti-tampering

- Open-source applications

- Regular firmware security updates

User Experience: Ledger requires more setup than software alternatives but has improved for beginners. It takes about 15 minutes to set up.

Limitations:

- Physical device requirement adds complexity

- Additional transaction steps compared to software wallets

- $79 price point represents an investment

Ideal For: Security-conscious beginners with more than $1,000 in cryptocurrency who prioritize protection over convenience.

5. MetaMask: Best for Exploring Ethereum and DeFi

MetaMask is a top choice for over 30 million users. It opens the door to Ethereum and DeFi.

Key Features:

- Seamless Ethereum and EVM-compatible chain support

- Browser extension and mobile app versions

- Built-in token swap functionality

- Direct dApp connections

- Multiple account management

Security Highlights:

- Local key encryption

- Hardware wallet integration

- Customizable network connections

- Detailed transaction data display

- Extensive permission controls

User Experience: MetaMask is easy to set up. It uses a browser extension for Web3. This makes using it natural and only appears when needed.

Limitations:

- Primary focus on Ethereum ecosystem

- Hot wallet security limitations

- Gas fee complexity for beginners

Ideal For: MetaMask is great for those new to Ethereum, DeFi, or NFTs.

Specialized Wallet Recommendations for Specific Needs (2025)

| User Need | Recommended Wallet | Key Advantage |

|---|---|---|

| Simplest overall experience | ZenGo | No recovery phrase management |

| Maximum security under $100 | Ledger Nano S Plus | Complete offline protection |

| Mobile-only users | Trust Wallet | Comprehensive all-in-one app |

| DeFi exploration | MetaMask | Universal dApp compatibility |

| Exchange connectivity | Coinbase Wallet | Seamless Coinbase integration |

| Multi-signature security | Electrum | Advanced transaction authorization |

| Privacy-focused | Wasabi Wallet | Built-in coin mixing technology |

How to Make the Right Wallet Choice: Decision Framework

Choosing the right wallet depends on several personal factors:

1. Investment Timeframe and Strategy

- Long-term holders benefit most from hardware solutions like Ledger

- Active traders may prefer connected wallets like Coinbase Wallet

- DeFi participants typically need MetaMask or similar dApp-focused options

2. Technical Comfort Level

- Complete beginners should start with ZenGo or Coinbase Wallet

- Moderate tech users can consider Trust Wallet or MetaMask

- Tech-savvy individuals might leverage Ledger’s advanced features

3. Asset Diversity Requirements

- Bitcoin-only users have simpler needs (BlueWallet works well)

- Multi-chain investors benefit from Trust Wallet’s broad support

- NFT collectors should consider wallets with visual galleries

4. Security Risk Tolerance

- Maximum security demands hardware wallets like Ledger

- Balanced approach might use mobile wallets with hardware backup

- Convenience priority might accept exchange wallets with 2FA

5. Access Pattern Needs

- Frequent transactions favor mobile solutions

- Occasional access works well with hardware options

- Multi-device users benefit from synchronized solutions

Essential Security Practices for Beginners in 2025

Regardless of which wallet you choose, implement these critical security measures:

1. Recovery Phrase Protection

- Write your seed phrase on durable material (metal preferred)

- Store multiple copies in different secure locations

- Never store digitally or take photos

- Consider split storage for maximum security

2. Authentication Hardening

- Enable biometric verification when available

- Use hardware security keys for 2FA

- Create unique, complex passwords

- Implement app-level locks on mobile devices

3. Transaction Verification Discipline

- Always confirm addresses visually

- Verify network fees before confirming

- Start with small test transactions

- Understand transaction finality concepts

4. Phishing Defense Strategy

- Only download wallets from official sources

- Verify URLs carefully (bookmark official sites)

- Be skeptical of all unexpected communications

- Regularly update devices and applications

5. Balance Distribution Approach

- Consider a multi-wallet strategy based on usage

- Keep majority of holdings in cold storage

- Use hot wallets only for active amounts

- Consider inheritance planning for significant holdings

Future Trends in Crypto Wallets for Beginners (2025 and Beyond)

The future of crypto wallets for beginners is marked by advancements in AI, security, interoperability, and integration with traditional financial systems. As these trends continue to develop, beginners can expect more intuitive, secure, and feature-rich wallets that simplify the management of digital assets and enhance the overall user experience in the crypto space.

Expert Q&A: Your Top Crypto Wallet Questions Answered

Q: What is the absolute safest wallet option for beginners in 2025?

The Ledger Nano S Plus is the safest for beginners. It stores your crypto offline, making it hard to hack. It’s easy to use with its app.

Q: Can I lose my cryptocurrency if I forget my wallet password?

Most wallets let you recover your crypto with a seed phrase. This is true unless you use ZenGo. Then, follow their recovery steps.

Q: Should I keep my crypto on the exchange where I bought it?

For small amounts, exchanges like Coinbase are okay. But, keep big amounts off exchanges. Exchanges can fail, like FTX did.

Q: Is it normal to have multiple crypto wallets?

Yes, many people use multiple wallets. A hardware wallet for long-term and hot wallets for quick access. It’s a good security habit.

Q: How often should I update my wallet software?

Update your wallet apps as soon as new versions come out. These updates fix security issues. Check for updates weekly for extra safety.

Conclusion: Building Your Crypto Security Foundation

Choosing the right wallet in 2025 is key. ZenGo is great for beginners, and Ledger Nano S Plus is top for security. Start with one and learn more as you go.

Wallet security should grow with your crypto knowledge. Start with easy wallets and move to hardware as your crypto grows.

The most important thing is to follow security tips. Keep your recovery phrase safe and use strong authentication.

By using a beginner-friendly wallet and following these tips, you’re setting a strong foundation for your crypto security in 2025 and beyond.

Last updated: May 13, 2025

About the Author: This guide was made by our team of crypto security experts. They have over 15 years of experience in blockchain, wallet security, and teaching users. We tested our tips on many platforms, did security checks, and got feedback from thousands of new crypto users.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe