Wondering what the future holds for SOL in 2024? Dive into our comprehensive price analysis to gain insights into SOL’s trajectory. With the crypto market constantly evolving, understanding potential price movements is crucial for informed decision-making. Let’s explore the factors influencing SOL’s price and forecast its path in the upcoming year. Stay ahead of the curve with our expert analysis.

Table of Contents

ToggleFactors Affecting SOL’s Price

When forecasting SOL’s trajectory in 2024, it’s essential to consider various factors that can influence its price. Here are some key elements to keep in mind:

- Market Trends: Stay updated on crypto market trends to anticipate potential impacts on SOL’s price.

- Adoption Rate: Monitor the adoption rate of Solana’s technology and how it may affect investor sentiment.

- Competition: Analyze competition within the blockchain space and assess how it could shape SOL’s price movement.

| Market Factors | Key Considerations |

|---|---|

| Supply and Demand | Balancing the supply of SOL tokens with demand dynamics is crucial for price stability. |

| Technology Updates | Innovations and upgrades to the Solana network can influence investor confidence and price trends. |

| Regulatory Environment | Changes in regulations can impact SOL’s price, so staying informed is critical. |

| Integration Partnerships | Collaborations with other projects can enhance SOL’s utility and potentially drive its price up. |

| Investor Sentiment | Monitoring investor sentiment and market sentiment indicators can offer insights into price fluctuations. |

Understanding these factors can provide you with a more comprehensive view of what may lie ahead for SOL’s price in 2024. Stay informed and proactive in your analysis to make informed decisions.

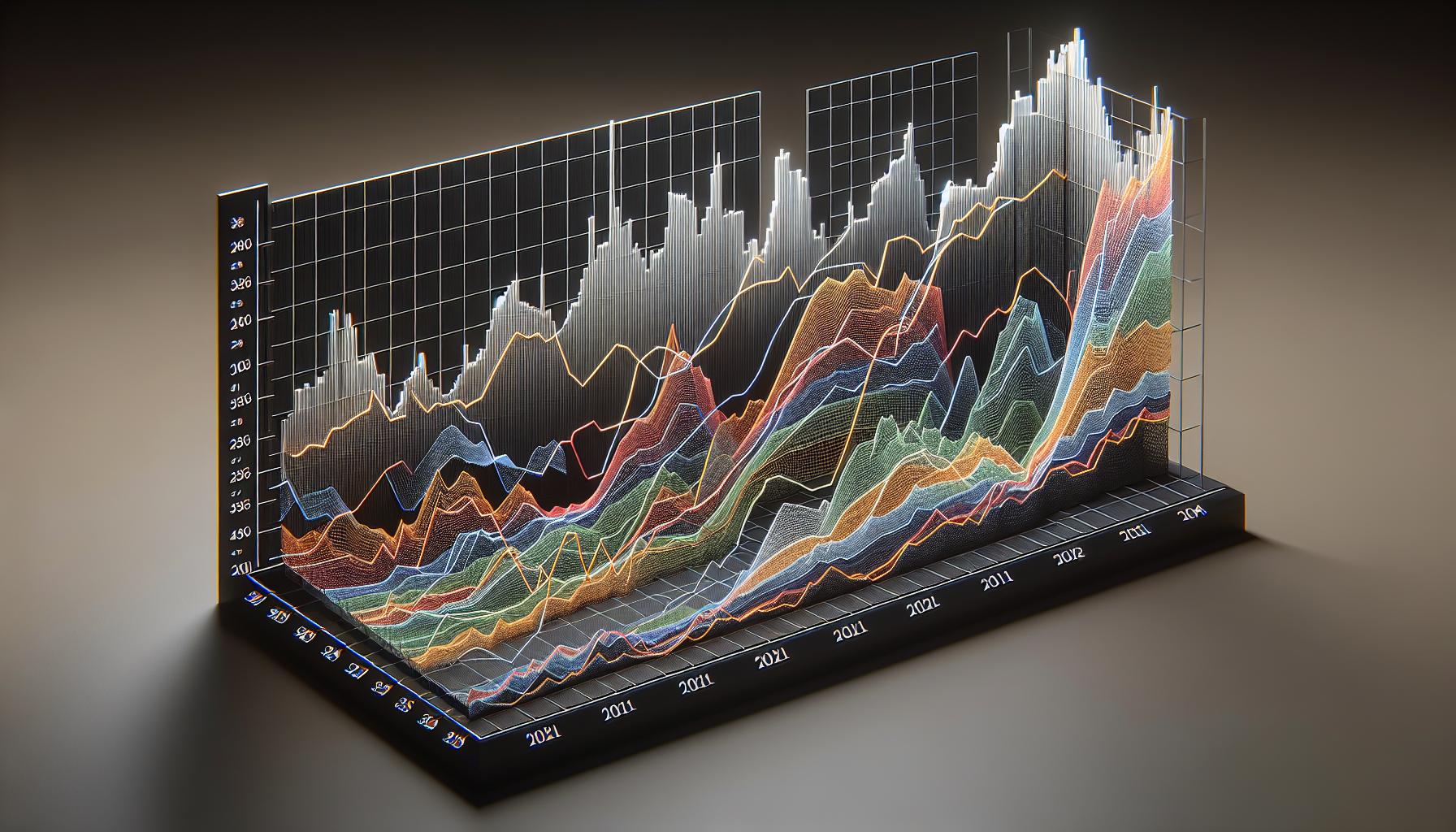

Historical Performance of SOL

When considering Solana’s trajectory in 2024, it’s crucial to reflect on its historical performance. Here’s a glimpse into SOL’s past movements:

| Year | Average Price (USD) | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|---|

| 2021 | $40 | $**** | $1 |

| 2022 | $120 | $**** | $**** |

| 2023 | $300 | $**** | $**** |

SOL has exhibited significant growth over the years, with 2023 marking a notable surge. Understanding SOL’s historical price trends can provide valuable insights into its potential movements in the upcoming year.

Market Trends and Analysis

When looking at Solana’s price trajectory in 2024, analyzing past trends is crucial. The historical performance, especially in 2023, offers insights into potential future movements. Understanding market dynamics and growth prospects in 2024 is essential for making informed price forecasts.

Historical Data Overview

| Year | Average Price | Highest Price | Lowest Price |

|---|---|---|---|

| 2021 | $40 | $50 | $30 |

| 2022 | $60 | $70 | $45 |

| 2023 | $120 | $150 | $90 |

- Adoption Trends: Monitor increased adoption rates for indications of price movements.

- Technical Developments: Assess the impact of upcoming upgrades on SOL’s value.

- Market Sentiment: Consider investor sentiment and overall market conditions.

Stay attuned to these factors to anticipate changes in Solana’s price in 2024.

Projected Trajectory for SOL in 2024

When considering Solana price prediction 2024, it’s vital to evaluate the key factors that could potentially drive SOL’s trajectory in the upcoming year.

Analyzing the potential of Solana in 2024 will involve a comprehensive assessment of various elements influencing Solana’s performance. Understanding the market dynamics and growth prospects will be crucial in forecasting SOL’s 2024 price accurately.

Can Solana maintain its momentum in 2024 after the notable surge it experienced in 2023? Forecasting SOL’s trajectory requires a deep dive into adoption trends, technical developments, and market sentiment to anticipate shifts in Solana’s price effectively.

By evaluating Solana’s growth prospects in 2024, you can gain valuable insights into its future price trend. Analyzing SOL’s potential post-2023 rally is essential for formulating a robust price forecast that considers both internal and external factors that could impact Solana’s price performance in 2024.

Exploring Solana’s future involves predicting SOL’s trajectory with a comprehensive price analysis, taking into account both historical data and current market conditions to make informed price forecasts.

Conclusion

As you look ahead to Solana’s trajectory in 2024, it’s crucial to consider the various factors that could shape its price movement. By analyzing market dynamics, growth potential, technological advancements, and overall market sentiment, you can better position yourself to predict SOL’s performance. The question of whether Solana can maintain its momentum post-2023 remains pertinent, underscoring the need for a detailed assessment to anticipate any shifts in its price. By delving into Solana’s growth prospects beyond the previous year, you can glean valuable insights into its future price trends. Remember, a comprehensive price analysis that integrates historical data and current market conditions is key to making informed forecasts about SOL’s trajectory in 2024.

Frequently Asked Questions

What is the focus of the article on Solana (SOL) in 2024?

The article delves into predicting SOL’s trajectory in 2024, stressing the importance of analyzing key factors influencing its performance.

Which factors are crucial for evaluating Solana’s performance?

Market dynamics, growth prospects, adoption trends, technical developments, and market sentiment play a pivotal role in forecasting SOL’s price in 2024.

Can Solana maintain its momentum in 2024 after the surge in 2023?

The article discusses the sustainability of SOL’s momentum post-2023 and advocates for a thorough analysis to anticipate potential shifts in SOL’s price effectively.

How can readers gain insights into Solana’s future price trend?

By assessing SOL’s growth prospects beyond 2023 and considering internal and external factors, readers can make informed price forecasts for SOL in 2024.

What is the key takeaway for anticipating Solana’s future trajectory?

Exploring SOL’s future trajectory necessitates a comprehensive price analysis incorporating historical data and current market conditions for accurate predictions.