Embark on a journey into the realm of Bitcoin mining, where the creation of digital currency meets the complexities of a rigorous process. In this article, we will unravel the enigmatic nature of Bitcoin mining, exploring the time, cost, and profitability associated with this captivating endeavor. Through a technical and analytical lens, we will delve into the intricacies of mining, shedding light on the factors that influence its duration, expenses, and environmental impact. Join us in uncovering the secrets of this ever-evolving industry.

Table of Contents

ToggleKey Takeaways

- On average, it takes around 10 minutes to mine one Bitcoin, but the time can vary depending on factors like network difficulty and computational power.

- The cost of mining a Bitcoin can reach up to $73,000, including expenses for hardware, electricity, and maintenance.

- Bitcoin mining profitability depends on factors such as the Bitcoin price and mining difficulty, and it is essential to consider equipment costs and potential returns before engaging in mining activities.

- Other cryptocurrencies like Ethereum can also be mined using similar principles, and researching different mining options can help diversify mining activities.

Time to Mine a Bitcoin

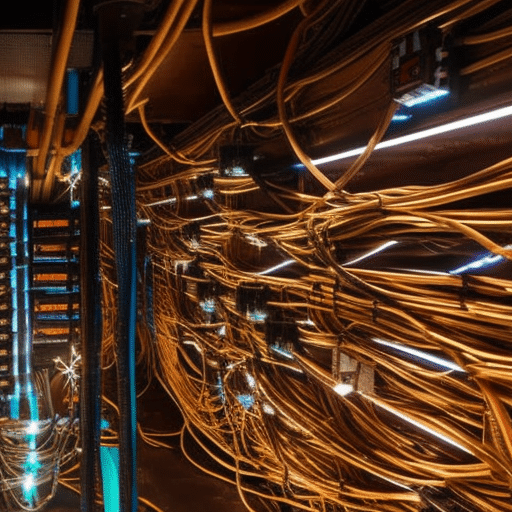

The average duration to mine one Bitcoin is approximately 10 minutes. This process involves complex mathematical calculations performed by specialized mining hardware. Miners compete to solve these calculations and secure new Bitcoin transactions by adding them to the blockchain. However, traditional mining methods have raised concerns about their environmental impact due to the significant energy consumption involved. To address this issue, the industry is exploring energy-efficient mining hardware solutions that optimize computational power while reducing power consumption. Additionally, miners are increasingly looking towards renewable energy sources for mining operations. Regions with access to abundant renewable energy, such as hydropower, have become attractive locations for mining farms. The ongoing development of more energy-efficient mining hardware and the use of renewable energy sources are crucial steps towards minimizing the environmental footprint of Bitcoin mining.

Cost of Bitcoin Mining

To understand the financial implications of Bitcoin mining, it is important to consider the costs associated with this process. One of the major expenses in Bitcoin mining is electricity costs. Mining equipment requires substantial power, leading to high electricity expenses. Depending on local electricity costs, the cost of processing a Bitcoin can reach up to $73,000. Additionally, hardware expenses are a significant factor in the cost of mining a Bitcoin. Miners need to invest in powerful and efficient hardware to compete in the mining network. The overall cost of mining a Bitcoin includes hardware, electricity, and maintenance expenses. It is crucial for miners to carefully assess these costs and potential returns before engaging in mining activities.

Factors Affecting Bitcoin Mining Profitability

Factors that impact the profitability of Bitcoin mining include the price of Bitcoin, mining difficulty, and the cost of equipment and electricity.

- Price of Bitcoin: The value of Bitcoin directly affects mining profitability. When the price is high, miners can earn more for the Bitcoins they mine.

- Mining Difficulty: As the network’s computational power increases, mining difficulty also rises. Higher mining difficulty means it takes more computational power and time to mine new Bitcoins, leading to lower profitability.

- Cost of Equipment: The initial investment in mining equipment can significantly impact profitability. High-quality hardware can mine more efficiently and generate higher profits.

- Electricity Cost: Mining operations consume substantial electricity, which contributes to mining expenses. Miners need to consider the cost of electricity in their location when calculating profitability.

Understanding these factors and regularly evaluating their impact on mining profitability is crucial for miners to make informed decisions and maximize their returns.

Bitcoin Mining Vs. Alternative Cryptocurrencies

Bitcoin mining and alternative cryptocurrency mining can be compared and contrasted to determine their unique benefits and drawbacks. One aspect to consider is the mining algorithms used by Bitcoin and alternative cryptocurrencies. Bitcoin uses the SHA-256 algorithm, while alternative cryptocurrencies like Ethereum use algorithms such as Ethash or ProgPoW. These different algorithms have varying levels of complexity and computational requirements, which can impact the efficiency and profitability of mining.

When it comes to mining alternative cryptocurrencies, there are potential risks and rewards to consider. On the one hand, mining alternative cryptocurrencies may offer higher potential rewards due to their lower market prices and lower mining difficulty. This can provide an opportunity for miners to accumulate a larger quantity of coins. However, there are also risks involved, such as the volatility and uncertainty surrounding the value and future prospects of these alternative cryptocurrencies. Additionally, mining alternative cryptocurrencies may require different hardware and software configurations, which can add complexity to the mining process. Overall, miners should carefully evaluate the potential risks and rewards before deciding to mine alternative cryptocurrencies.

Environmental Impact of Bitcoin Mining

The environmental impact of Bitcoin mining has raised concerns due to its significant energy consumption. As the demand for Bitcoin continues to grow, the energy requirements for mining are also increasing. Here are some key points to understand the environmental impact of Bitcoin mining:

- Massive Energy Consumption: Bitcoin mining consumes a substantial amount of electricity, comparable to the energy usage of some countries.

- Carbon Footprint: The high energy consumption of Bitcoin mining contributes to a significant carbon footprint, contributing to greenhouse gas emissions.

- Renewable Energy Solutions: Miners are exploring renewable energy sources like solar and wind power to reduce the environmental impact of mining operations.

- Carbon Footprint Reduction: Utilizing renewable energy solutions can help reduce the carbon footprint of Bitcoin mining and make the process more sustainable.

Efforts are being made to develop more energy-efficient mining hardware and promote the use of renewable energy sources to mitigate the environmental impact of Bitcoin mining.

Network Difficulty and Computational Power

With the increasing complexity of the network and the growing computational power required, miners face significant challenges in Bitcoin mining. Network difficulty refers to the measure of how difficult it is to mine a new block in the blockchain. A higher network difficulty means that miners need more computational power to solve complex mathematical problems and validate transactions. The impact of network difficulty on mining efficiency is substantial. As network difficulty increases, it becomes harder for miners to mine new Bitcoins, resulting in longer mining times and reduced profitability. Computational power plays a crucial role in mining success. Miners with higher computational power have a higher probability of solving the mathematical problems and being rewarded with new Bitcoins. Therefore, miners need to continually upgrade their hardware to keep up with the increasing network difficulty and maintain their mining efficiency.

Electricity Expenses and Mining Equipment

As miners navigate the challenges of network difficulty and computational power, they must also carefully consider the significant electricity expenses and mining equipment required for Bitcoin mining. These considerations are crucial for ensuring profitability and sustainability in the mining process. Here are the key points to understand:

- Electricity consumption: Bitcoin mining demands a substantial amount of electricity, resulting in high expenses. Miners should factor in the cost of electricity when calculating their profitability.

- Carbon footprint reduction: The environmental impact of Bitcoin mining has raised concerns. Miners are exploring renewable energy sources to reduce their carbon footprint and make their operations more sustainable.

- Impact of network difficulty: Network difficulty affects mining speed. As the network difficulty increases, it becomes harder to mine new Bitcoins, requiring more computational power and electricity consumption.

- Mining equipment: Miners need to invest in specialized hardware to efficiently mine Bitcoins. The cost of equipment, along with electricity and maintenance expenses, should be considered when determining the overall cost of mining.

Joining Mining Pools and Shared Rewards

Joining a mining pool allows miners to share computational power and receive shared rewards. Mining pools are groups of miners who collaborate to increase their chances of successfully mining a block and earning rewards. By combining their resources, miners can collectively solve complex mathematical problems more efficiently. The rewards for mining a block are then distributed among pool participants based on their contribution.

Joining mining pools can be beneficial for miners looking to maximize their mining rewards. By pooling their resources, miners can increase their chances of successfully mining a block and earning a reward. This is especially useful for individual miners who may not have enough computational power to mine on their own. Additionally, mining pools often provide a more consistent income stream since rewards are distributed more frequently.

However, it is important to note that joining mining pools also means that the rewards are divided among participants. The more computational power a miner contributes to the pool, the larger their share of the rewards. It is crucial for miners to choose a reputable and reliable mining pool to ensure fair distribution of rewards.

Market Trends and Mining Profitability Fluctuations

The volatility of market trends significantly impacts the profitability of Bitcoin mining. Understanding market demand and predicting the future of mining profitability is crucial for miners to ensure their operations remain profitable. Here are four key points to consider:

-

Bitcoin Price Fluctuations: The price of Bitcoin directly affects mining profitability. When the price is high, miners can generate more revenue from mining rewards. Conversely, a drop in price can reduce profitability.

-

Mining Difficulty Adjustments: The mining difficulty of Bitcoin adjusts every 2016 blocks to maintain a consistent block production rate. Higher mining difficulty means more computational power is required, resulting in increased costs for miners.

-

Energy Costs: The cost of electricity is a significant factor in mining profitability. Changes in electricity prices can have a substantial impact on a miner’s bottom line.

-

Technological Advancements: The future of mining profitability depends on technological advancements. More efficient mining equipment and software can increase profitability by reducing electricity consumption and improving mining efficiency.

Staying informed about market trends and adapting mining strategies accordingly is vital for miners to navigate the dynamic landscape of Bitcoin mining profitability.

Frequently Asked Questions

What Is the Process of Verifying Bitcoin Transactions and Adding Them to the Blockchain?

The process of verifying Bitcoin transactions and adding them to the blockchain involves the use of cryptographic algorithms by miners. Miners play a crucial role in maintaining the integrity of the blockchain and ensuring the validity of transactions.

How Does the Mining Difficulty of Bitcoin Change Over Time?

The mining difficulty of Bitcoin changes over time due to the impact of technological advancements and the relationship between Bitcoin price and mining difficulty. These factors contribute to the dynamic nature of Bitcoin mining difficulty.

Are There Any Potential Risks or Challenges Involved in Bitcoin Mining?

Potential risks and challenges in Bitcoin mining include the significant environmental impact due to high electricity consumption and regulatory challenges as governments seek to address concerns regarding energy usage, taxation, and potential illicit activities in the industry.

Can Mining Cryptocurrencies Other Than Bitcoin Be More Profitable?

Ethereum vs Bitcoin: Which cryptocurrency is more profitable to mine? Exploring alternative cryptocurrencies for higher profitability. Factors such as price, mining difficulty, and personal preferences determine profitability. A technical, analytical, and informative style will be used to discuss the current question.

What Are Some Strategies That Miners Can Use to Reduce Their Electricity Expenses?

Some strategies for energy-efficient mining and cost-effective electricity solutions include using renewable energy sources, optimizing mining equipment for energy efficiency, joining mining pools, and locating mining farms in regions with low-cost electricity.