BlockDAG

$BDAGHigh-throughput DAG layer blending ASIC mining with an EVM execution layer, aiming for instant settlement and payment rails across BTC, ETH, and KAS integrations.

Base Dawgz

$DAWGZCross-chain meme coin built for Base with instant bridges to ETH, SOL, and BSC plus an airdrop quest hub rewarding social and staking activity.

Mega Dice

$DICETelegram-native casino launching a non-custodial Solana dApp where token stakers share wagering fees from dice, crash, and sportsbook products.

| Token | Raised | Current Stage | Payment / Utility | Action |

|---|---|---|---|---|

|

$BDAG |

>$420M raised | Live Batch 47 – $0.0178 | BTC, ETH, BNB, USDT, USDC, KAS, SOL, DOGE | Explore |

|

$DAWGZ |

>$12M raised | Live Stage 6 – $0.0320 | Base, ETH, BSC, SOL, USDT | Explore |

Mega Dice

Mega Dice$DICE |

>$5.6M raised | Live Stage 8 – $0.0950 | SOL, USDT, USDC, BTC, card | Explore |

|

$5SCAPE |

>$10.5M raised | Live Phase 10 – $0.0032 | ETH, USDT, BNB, Polygon | Explore |

|

$KANG |

>$7.8M raised | Live Stage 6 – $0.0295 | ETH, USDT, BNB, SOL | Explore |

|

$SPONGEV2 |

>$14M raised | Live V2 staking – $0.00192 | ETH, Polygon, USDT | Explore |

|

$BITBOT |

>$2.2M raised | Live Stage 9 – $0.0208 | ETH, USDT, bank card | Explore |

Scotty the AI

Scotty the AI$SCOTTY |

>$8.7M raised | Live Stage 14 – $0.0098 | ETH, USDT, BNB | Explore |

|

$BLP |

>$5.1M raised | Live Stage 6 – $0.0250 | Blast, ETH, USDT | Explore |

Surprising fact: “BlockDAG” has raised $364 million in presales before going public, a huge amount that changes how we think about early-stage token momentum.

This isn’t just hype; I keep track of presale numbers, product trials, and stake stats. I’ll list the amounts of money that Bitcoin Hyper has raised ($6.8M), Snorter Bot’s ($2.7M), and Token6900’s ($1.6M), and then I’ll talk about what that can mean for price discovery.

When I guess, I make it clear that they are just ideas and not promises. I also talk about the tools I use to make sure that claims and on-chain statistics are correct.

You will learn about the direction of the market, the most popular types of projects, and how to get in as a U.S. reader, such as setting up a wallet and reading Know Your Customer (KYC) notes. You will also learn about investment red flags to keep an eye out for.

How we selected today’s top crypto presales (methodology and signals)

My approach ranks offerings by on-chain evidence and real-world delivery. I score each project using clear, repeatable signals so readers get actionable insights, not speculation.

Core filters: shipped product or demo, on-chain traction, independent audits, and roadmap delivery pace. I prefer projects with transparent repos and contracts; if an audit exists, that moves the score up. Solaxy, for example, shows credibility with a Coinsult audit.

Token design matters. I check supply, emissions, vesting, and whether stated staking rewards are sustainable or just headline bait. Bitcoin Hyper’s 153% APY is a red flag to stress-test against emissions and liquidity models.

How To Find Presale Crypto?

You can find crypto presales by:

- Checking trusted launchpads – Binance Launchpad, CoinList, DAO Maker, Polkastarter.

- Using ICO calendars – CoinMarketCap, CoinGecko, ICO Drops.

- Following project social media – Twitter/X, Telegram, Discord for official announcements.

- Joining crypto communities – Reddit, crypto forums, and Discord groups.

Always research the project’s team, whitepaper, tokenomics, and audits before investing.

Best Crypto Presales 2025

Investors seeking early entry should understand how presales operate. First, projects announce their strategies, including token quantities and pricing. Then, investors complete KYC verification and transfer funds through the project’s platform. Subsequently, tokens are distributed according to the project’s plan.

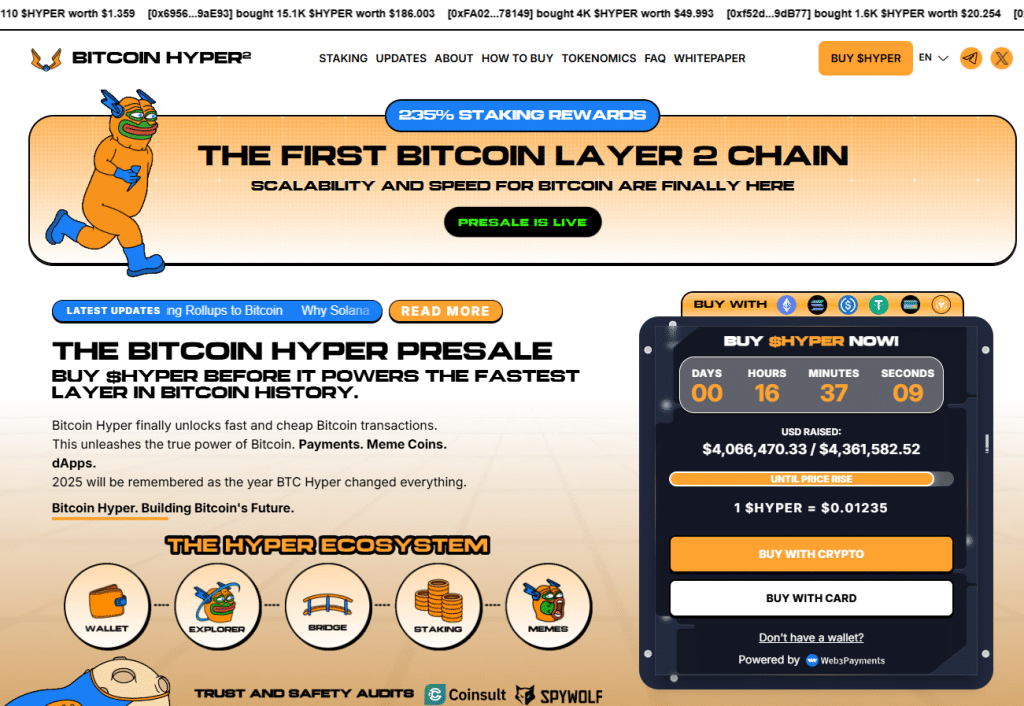

1. Bitcoin Hyper (HYPER): Bitcoin security meets Solana-class speed

What caught my eye about Bitcoin Hyper is the clear push to marry rock-solid security with low-latency payments.

Current snapshot: the project has raised roughly ~$6.8M and lists the presale token near ~$0.012525. Staking shows a headline APY up to 153%, which reads like a bootstrapping incentive more than a sustainable payout.

Technology and use case

Bitcoin Hyper combines an SVM-based L2 with ZK rollups to anchor finality to Bitcoin while targeting Solana-level throughput. That architecture aims for fast settlement and low fees—key for retail payments.

- Thesis: Bitcoin-grade security plus near-instant speed could enable instant merchant checkouts.

- Risk: bridges and ZK circuits must pass rigorous audits before I add size.

- Signal to watch: wallet growth and merchant pilots—payments need both sides active.

| Metric | Value | Why it matters |

| Raised | ~$6.8M | Mid-range traction for a technical L2 |

| Presale price | ~$0.012525 | Sets early price discovery frame |

| Staking APY | 153% | Bootstrap rewards; watch dilution |

“If this delivers, utility wins: real payments on Bitcoin rails with modern speed.”

2. TOKEN6900 (T6900): meme momentum with staking yield

TOKEN6900 is a social-first play that monetizes memes with staking hooks. The project offers a low entry price near $0.006825 and a culture-forward identity built to amplify viral moments.

Market positioning

This is a meme coin that leans into community mechanics, contests, and content drives. Low ticket size lowers the barrier to entry and raises sensitivity to social catalysts.

Presale progress and stats

TOKEN6900 has raised roughly $1.6M — about 32% of a $5M cap. The ongoing presale shows traction without obvious overheating. Staking yields near ~38% act as short-term engagement rewards.

- I size smaller on culture plays; volatility is high and moves fast on social hype.

- Watch distribution fairness, treasury transparency, and post-listing liquidity plans.

- If daily engagement holds and emissions stay sane, the token can carry momentum into listing windows.

| Metric | Value | Why it matters |

| Raised | $1.6M (~32% of cap) | Shows initial demand, room to scale |

| Presale price | $0.006825 | Low ticket entry; high price elasticity |

| Staking APY | ~38% | Boosts engagement; watch dilution |

“Culture wins attention; discipline wins longevity.”

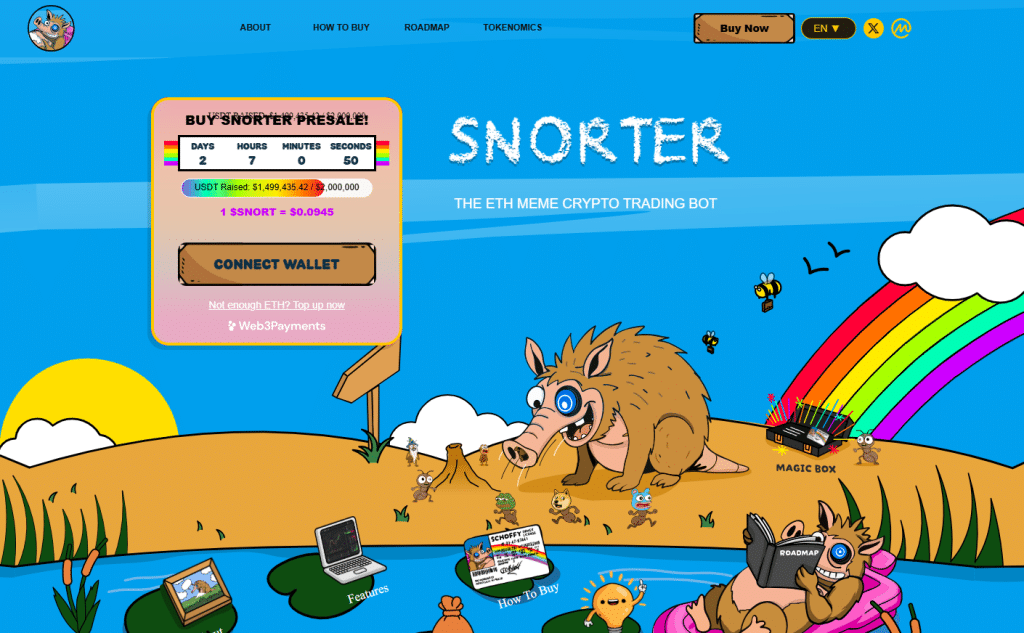

3. Snorter Bot (SNORT): trader-focused utility with live-learning AI

Snorter’s live-learning stack aims to move traders from guesswork to measurable edge. The platform sells token-gated access to premium bot upgrades, algorithmic tools, and trading competitions. With >$2.7M raised and a presale price near $0.1001, this is a mid-tier offering aimed at active users, not casual dabblers.

Access and tools: bot tiers, algorithmic features, governance

The token unlocks tiered bots and modular algos you can tweak without coding. I value platforms that let me adjust signals and risk limits quickly.

Governance promises let the community vote on which indicators and competitions get priority. That matters: community-driven development speeds useful feature rollouts.

Fundraising context: evidence and price

Snorter has raised over $2.7M and lists the token around $0.10. That pricing leaves room for price discovery if daily active users and competition volume grow.

- Tools-first play: real trading features during presale can separate talk from delivery.

- Learning loop: does the bot update from community feedback and on-chain outcomes, or stay static?

- Risk controls: I look for built-in safety and rug detection before allocating more than a small test amount.

“I test these tools with small allocations first—performance data over weeks beats any brochure.”

| Metric | Value | Why it matters |

| Raised | > $2.7M | Shows trader interest and funding runway |

| Presale price | ~ $0.1001 | Mid-tier entry for sophisticated users |

| Token utility | Access to bots, tools, competitions, governance | Aligns incentives and gates premium features |

em silly, but when you’re making money while others are getting rugged, you’ll probably find it pretty endearing.

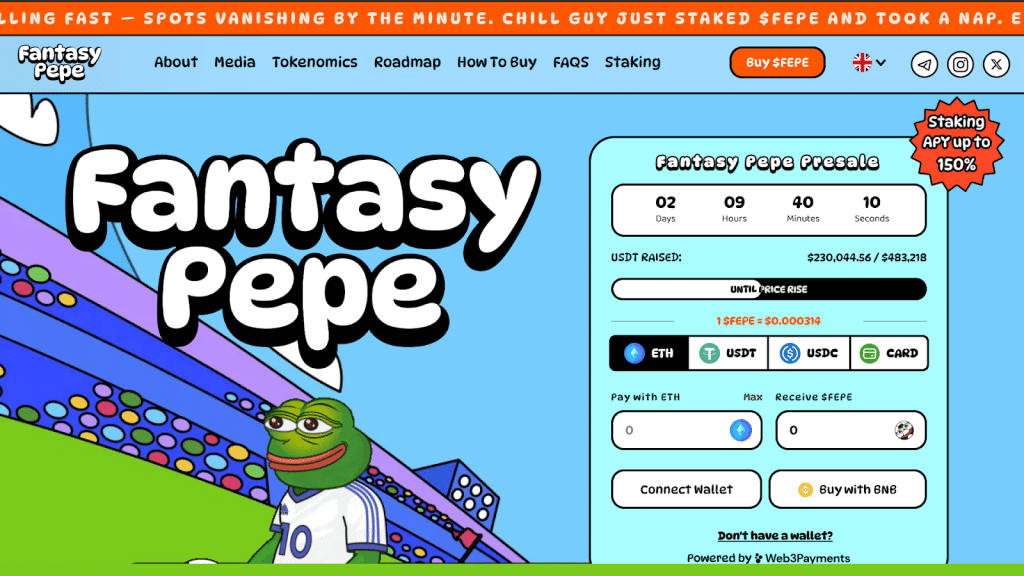

4. Fantasy Pepe – The Ultimate Meme Football Token

Price Now: $0.00025 (Stage 3)

Listing Price: $0.00060 → 140% instant gain potential

Min Investment: $50 | Raised: $2.1M of $3.5M cap

What Is It?

Meme coin + P2E gaming. Buy $FPEPE → Get NFT characters → Play to earn more tokens. Basically Pepe meets blockchain gaming.

Investment Comparison

MetricFantasy PepeTypical Meme CoinPresale Price$0.00025VariesListing Multiplier2.4x guaranteed1-2x averageUtilityP2E game + NFTsNoneStaking APY120%0-50%Liquidity Lock2 years0-6 monthsTeamDoxxedUsually anonymousAuditCertiK (pending)Often noneCommunity Size25K+5-10K average

Key Dates

- Now-Feb 28: Presale active

- March: Uniswap listing

- Q2 2025: Game launches

- Q3 2025: Major CEX listings

Why It Might Work

✅ Pepe brand recognition

✅ Actual utility (gaming)

✅ 120% staking APY at launch

✅ Doxxed team, audit pending

✅ 25K+ community already

The Risk

It’s a meme coin presale. Could 10x or go to zero. Game might flop. Team might not deliver. You know the drill.

Bottom Line

Early entry into a gaming meme coin at $0.00025 before $0.00060 listing. Has more utility than most meme coins but still high risk.

Stage 3 is 65% sold – probably 2 weeks left.

Fantasy Pepe has big plans for the future. They want to team up with pro football leagues and get famous people to support them. They also aim to grow into other sports.

The team behind Fantasy Pepe is full of experts. They have people who know blockchain well and others who are great at sports marketing. This mix of skills will help create exciting experiences for fans.

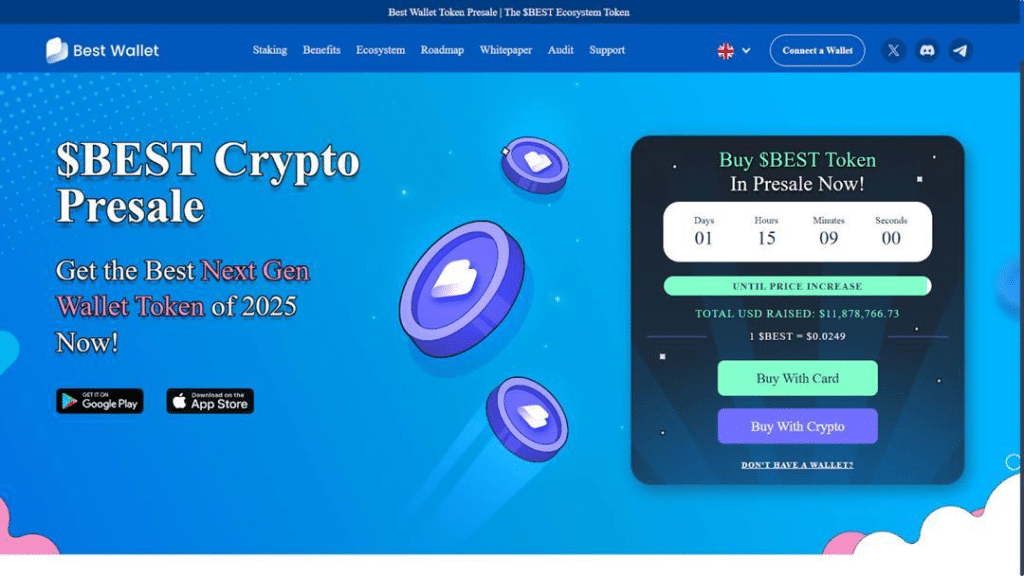

5. Best Wallet (BEST): multi-chain wallet with launch access and analytics

I judge a wallet by how often I open it and how many tasks it finishes for me. A good one keeps me in-app: swaps, analytics, and launch flows without bouncing around.

Presale and perks: the project has raised >$13M with a current token price around $0.025255. The headline feature is an Upcoming tokens feed that grants two-week early access before public drops. That kind of access can matter for active hunters.

What matters in practice

The platform supports multiple chains, in-app swaps and bridges, and portfolio analytics. Those reduce friction and keep real users engaged.

- Everyday use: wallets are where most activity happens—analytics + DeFi flows matter.

- Security: hardware wallet compatibility and layered encryption are emphasized. I value that highly.

- Token gating: premium features tied to the token align incentives and encourage retention.

I’d like better alerting and automation—swap triggers, staking schedules, uptime guarantees. For allocation, treat a wallet token as utility exposure: it compounds with user growth. Watch feature velocity; reliability wins loyalty.

“Two-week early access through the upcoming feed is a real edge if the platform keeps integrations coming.”

Best Wallet Token stands out because it works with the financial systems we already know. It teams up with banks to make switching between traditional money and crypto easy. This makes it a key link between old finance and new blockchain tech.

The way the token is set up shows a focus on growing in a healthy way. The plan includes:

| Category | Percentage | Purpose |

|---|---|---|

| Presale | 30% | Early investor incentivization |

| Development | 25% | Ongoing platform enhancements |

| Liquidity | 20% | Market stability |

| Marketing | 15% | User acquisition |

| Team | 10% | Locked for 2 years with quarterly releases |

The team behind Best Wallet Token has a strong background. They come from top fintech and blockchain companies. Their skills in cybersecurity and design are key to making a reliable wallet.

Investors looking at crypto presales will find Best Wallet Token’s plan solid. It includes launching a mobile app, adding cross-chain features, and a rewards system for users.

3. SUBBD – The Leading AI Agent Creation Platform

Quick Summary

SUBBD lets anyone create and sell AI agents without coding. Think “Shopify for AI bots” – build, deploy, monetize.

Token Price Now: $0.00015

Listing Price: $0.00035 → 133% instant gain

Raised: $1.8M of $5M cap (Stage 2)

What Makes It Real

MetricStatusPlatformLive with 12K usersAgents Created3,500+Monthly Revenue$150KToken UtilityFees, staking (95% APY), governanceMarketplaceBuy/sell agents, 70/30 revenue split

The Platform

- No-code builder – Drag & drop AI agents

- 50+ templates – Customer service, trading bots, tutors

- Marketplace – Sell your agents for $29/month average

- Already profitable – Unlike 99% of crypto projects

Token Distribution

30% Presale | 25% Rewards | 20% Liquidity | 25% Team/DevWhy It Could Work

✅ Working product (not vaporware)

✅ Real revenue ($150K/month)

✅ AI narrative + actual utility

✅ First-mover advantage

✅ 300% monthly user growth

Timeline

- Now-April: Presale active

- May 2025: DEX listing

- Q2 2025: Mobile apps

- Q3 2025: CEX listings

Bottom Line

Unlike meme coins or concept tokens, SUBBD has a live platform making money. At $0.00015 presale vs $0.00035 listing, you get 133% paper gains plus a real business behind it.

Risk: Medium-Low (product exists)

Potential: 2.3x guaranteed, 10-20x if AI boom continues

SUBBD’s economic model allocates tokens strategically to ensure long-term viability:

| Allocation | Percentage | Purpose |

|---|---|---|

| Presale | 30% | Early investor incentives |

| Development | 25% | Platform enhancement and R&D |

| Liquidity | 20% | Market stability |

| Marketing | 15% | User acquisition and partnerships |

| Team | 10% | Talent retention (18-month vesting) |

The total supply of BTFD Coin is capped at 1 billion tokens. It has anti-dumping mechanisms like gradual vesting for big holders and buyback from fees. This helps keep the market balanced.

Experienced Team from Tech Giants

The BTFD Coin team is led by former big names like OpenAI, Google, and Microsoft. The founder has a history of success in AI startups. The technical team is skilled in blockchain and machine learning.

Ambitious Development Roadmap

SUBBD’s timeline shows a clear plan and achievable goals:

- Q1 2025: Beta platform launch with basic agent creation tools

- Q2 2025: Marketplace opening with initial agent templates

- Q3 2025: Advanced customization features and API integrations

- Q4 2025: Mobile application and enterprise solutions

The presale has caught the eye of blockchain and AI communities. It’s seen as a top crypto presale with real innovation and practical uses in the AI market.

6. BTFD Coin: The Most Explosive Presale Crypto of 2025

The Quick Hit

“Buy The F***ing Dip” coin that actually buys the dip. Smart contract triggers automatic buybacks when price drops 10%+.

Price Now: $0.000064

Listing: $0.0006 → 837% guaranteed gain

Raised: $4.3M in 3 weeks (fastest ever)

Why It’s Different

FeatureStatus90% APY StakingLive NOWP2E GameBeta activeAuto BuybacksOn 10% dipsBulls Squad NFTsGame boostersCommunity45K Telegram, 78K Twitter

The Numbers

- Stage 7: 70% sold (ending soon)

- Next Stage: $0.00008 (+25%)

- Holders: 7,500+

- Daily Volume: $2M+

Token Distribution

48% Presale | 30% Staking | 12% Liquidity (10yr lock) | 10% Burns

Investment Math

$1,000 today = 15.6M tokens

At listing = $9,370 (837% gain)

Plus = 90% staking + game earnings

Why Now?

✅ Staking live (not “soon”)

✅ Game playable

✅ Fastest presale to $4M

✅ Perfect meme (“BTFD”)

✅ Dip protection mechanics

Bottom Line

BTFD turns market dips into pumps with auto-buybacks. Stage 7 at $0.000064 before $0.0006 listing. Most explosive presale metrics of 2025.

Risk: High (it’s a meme)

Reward: 8x minimum, possibly 100x

7. MIND of Pepe – The Premier AI Agent Crypto Presale for 2025

MIND of Pepe is a top pick among the best crypto presales of 2025. It combines the fun of meme coins with advanced AI tech. This project uses AI to make the Pepe world smarter, learning from what users do and grow with their input.

Revolutionary AI Integration

MIND of Pepe’s AI changes how we use meme tokens. It gives each user a unique experience based on their likes. The AI looks at market trends and gives tips on when to buy or sell.

This smart system keeps up with market changes. It helps investors make better choices when the market is shaky.

Unique Tokenomics Structure

The MIND of Pepe tokenomics model features a deflationary mechanism designed for long-term value appreciation. The distribution allocates:

| Allocation Purpose | Percentage |

|---|---|

| Presale Investors | 40% |

| AI Development | 25% |

| Liquidity Pool | 15% |

| Marketing | 10% |

| Team & Advisors | 10% |

Early investors in MIND of Pepe get big bonuses. They also get extra rewards for joining AI training programs. The token has a 2% burn on transactions, which slowly reduces the supply. This could make the token value go up over time.

Expert Development Team

The team behind MIND of Pepe is top-notch. They have experience from big tech companies. Dr. Alex Chen, a former AI researcher at DeepMind, leads the team. Sophia Williams, a blockchain architect, also works on the project.

Together, they bring innovation and market success to MIND of Pepe.

Clear Roadmap to Success

MIND of Pepe has a detailed plan for 2025:

- Q1: Presale ends and DEX listing happens

- Q2: Basic AI features and mobile app launch

- Q3: Advanced AI features, like predictive analytics, are added

- Q4: Expansion to other chains and major exchange listings

The team has already made an AI prototype. They’ve shown they can meet their goals. Early users like the easy-to-use interface and smart AI.

Growing Community Engagement

MIND of Pepe is making waves in the crypto world. It has over 75,000 followers on social media and 30,000 active Discord members. The project lets token holders help decide on AI features.

This makes the community feel involved in the platform’s growth.

8. Solaxy – The World’s First Layer 2 Solution on Solana

Solaxy is a top crypto presale for 2025. It’s the first Layer 2 solution on Solana’s blockchain. It tackles Solana’s scalability issues without losing its speed and low costs.

The platform uses new rollup tech to handle transactions off-chain. Then, it confirms them on the main blockchain. This boosts transaction speed by 10 times, opening up new chances for apps needing fast computing.

Solaxy’s token is more than just for voting. It’s the main currency for paying fees in the ecosystem. People who hold tokens get to pay lower fees first. They can also stake their tokens to earn rewards from the network’s activity.

The tokenomics show a smart way to distribute tokens:

| Allocation | Percentage | Purpose |

|---|---|---|

| Presale | 30% | Early investor incentives |

| Ecosystem Growth | 25% | Developer grants and partnerships |

| Liquidity | 20% | DEX and CEX pairings |

| Team | 15% | Vested over 36 months |

| Marketing | 10% | Promotion and awareness |

The team behind olaxy has a strong background. They are former Solana Foundation engineers and Layer 2 specialists. They worked on scaling Ethereum. Their skills give Solaxy a big edge in building complex blockchain systems.

9. Wall Street Pepe (WEPE)

Official Site: wepetoken.com

Overview:

Wall Street Pepe ($WEPE) connects fun meme culture with serious financial tools. It was inspired by WallStreetBets. WEPE makes advanced trading easy for everyone, not just big investors.

Key Features:

- Institutional-Grade Trading Tools: Offers top-notch trading signals and market insights. It also has platforms for finding opportunities together.

- Community-Centric Governance: Uses decentralized decision-making. Token holders help shape the project and its future.

- Optimized Transaction Structure: Has fees that are good for both investors and merchants.

Expert Tip:

The presale starts at $0.0003665. There’s also a 25% APY staking program. Early birds get a head start before the market opens.

10. SolPad (SPAD)

Official Site: solpad.io

Overview:

SolPad is a cutting-edge IDO platform and project incubator. It aims to change how early-stage funding works on the Solana blockchain. It provides a range of tools for launches, like advanced tokenomics calculators and flexible staking portals.

Key Features:

- Multi-Chain Compatibility: Makes it easy to start projects on different blockchain platforms like Solana, Binance Smart Chain, and Ethereum.

- Enhanced Yield Generation: Offers a staking and farming system. $SPAD holders get rewards that grow over time, encouraging them to stay involved for longer.

- Decentralized Decision Framework: Uses $SPAD as a voting token. This lets community members make important decisions for the ecosystem.

Expert Tip:

Staking $SPAD can give investors a chance at early access to new projects. It also earns them passive rewards as the platform grows.

11. Lightchain AI (LCAI)

Official Site: lightchain.ai

Overview:

Lightchain AI (LCAI) is a new blockchain architecture. It combines artificial intelligence with blockchain to improve app performance. It uses a unique Proof of Intelligence (PoI) and Artificial Intelligence Virtual Machine (AIVM).

This creates a smart, safe platform for future blockchain apps.

Key Features:

- Proof of Intelligence Consensus: Uses AI to validate transactions, making it more energy-efficient. It also keeps the network secure and scalable.

- AI-Optimized Virtual Machine: Offers a special environment for running AI tasks quickly and smoothly.

- Auditable AI Framework: Makes sure all AI actions are clear and can be checked. This builds trust in the system.

- Community-Driven Governance: Lets token holders help decide important protocol changes. This keeps the tech and community goals in sync.

9. TOKEN6900

TOKEN6900 is in an ongoing presale, having raised over $240,000 in just a week. It gives 80% of tokens to those who buy early, with a cap of $5 million New Crypto Presale TOKEN6900 Goes Live – SPX6900.

Presale Details:

- Current price: $0.0065 per token

- Maximum raise: $5 million

- Staking available: Up to 195% APY

- How to buy: Visit token6900.com, connect wallet, purchase with ETH/USDT/BNB or credit card

What It Is: TOKEN6900 is upfront about having no real value or plans. It calls itself a “meme coin” TOKEN6900: Better Than SPX6900 | The Best Crypto Presale. Unlike most, it doesn’t promise to be useful.

Expert Tip:

Right now, LCAI is available in presale at $0.007125 per token. Over $19.6 million has been raised so far. This is a great chance to invest early before the tokens are listed on exchanges.

Related Crypto Presales Articles

- Top Crypto Presales this Week

- Upcoming Crypto Presales 2025

- How to Buy Bitcoin Hyper in 2025

- How to Buy Bitcoin Bull (BTCBULL) 2025

- How to Buy Solaxy ($SOLX) in 2025

- How to Buy Fantasy Pepe

- Learn more about token6900

Tools to evaluate presales before you buy

Start with evidence: audits, on-chain locks, and a live contract test tell you more than a tweet. I run a quick checklist that flags missing pieces and saves time.

Smart contract audits, KYC, and rug-pull protection checks

Begin with audits where available. An audit is not perfect, but it shows a security mindset.

KYC matters for credibility on many launchpads. CoinList requires full KYC and has a track record of notable launches.

Verify liquidity locks and vesting on-chain. TrustSwap SmartLocks and TrustPad-style protections reduce rug-pull risk.

On-chain dashboards, DEX screeners, sentiment and bot analytics

Use DEXTools and DexScreener to watch pools, spreads, and real trades. On-chain explorers reveal token flows and vesting cliffs.

Sentiment scanners and a simple bot monitor help spot whale patterns and unusual volume. I run a small test transaction before scaling up.

Launchpads and access: what each platform signals

Launchpads differ by curation and protection. Binance Launchpad is curated; DAO Maker emphasizes community and incubation. TrustPad and TrustSwap focus on security mechanics and rug-pull guards.

Access windows vary — some platforms or wallets offer early entry (for example, Best Wallet’s ‘Upcoming tokens’). Integration with wallets and bridges is an important adoption signal for users.

Quick check table before commit:

| Check | Why it matters | How I verify |

| Audit | Reduces contract risk | Read report; check remediation timeline |

| Liquidity lock | Limits rug pulls | Verify lock contract on-chain (TrustSwap/TrustPad) |

| KYC | Platform credibility | Confirm launchpad rules (CoinList, Binance) |

| Vesting & treasury | Emission impact | Inspect vesting schedules on explorer |

“Run small tests, read reports, and watch locks — that three-step habit cuts a lot of risk.”

In short: use the right tools, prefer platforms with clear security mechanics, and check governance distribution before you buy. These steps help turn a hype moment into a reasoned trade in the current crypto presales market.

Step-by-step guide: how to buy presale crypto safely at present

Begin with a simple, testable setup: your wallet, a tiny funding transfer, and an exact purchase checklist. Small tests save time and money.

Wallet setup, base currency, and registration/KYC

- Set up a wallet: MetaMask or Trust Wallet for EVM flows. Consider Best Wallet for early access feeds if you want that advantage.

- Fund with the base currency the sale accepts — ETH, BTC, USDT, or USDC. Send a small test first to confirm routes and gas.

- Register on the project site or launchpad (Binance Launchpad, DAO Maker, TrustPad, TrustSwap, CoinList). Complete KYC and whitelist your wallet when required.

Purchase flow, token allocation, and vesting awareness

- Execute the purchase. Screenshot confirmations and save transaction hashes for records and tax notes.

- Understand allocation: many presale tokens arrive via airdrop or claim portal. Note network fees and claim windows.

- Map vesting schedules—cliffs, release cadence, and any lock tied to staking rewards; this affects short-term liquidity.

- Move assets to secure storage. Use a hardware wallet where possible and re-check contract addresses before approvals.

- Consider staking only after you vet lock risk and yield mechanics; diversify exposure and avoid staking your entire position.

- Track unlocks and price action with DEX screeners and portfolio dashboards. Prepare an exit plan—partial profit-taking beats panic.

“Do a tiny test first. It catches routing, fee, and KYC surprises before you commit real capital.”

Risk, security, and reliability: minimizing downside

Risk control starts with evidence: shipped features, public caps, and transparent token plans. I use simple checks to separate projects that can survive a listing shock from those that cannot.

Evidence-based diligence: milestones, hard caps, FDV, and utility

Anchor your diligence on hard caps and FDV. TOKEN6900’s $5M target matters because small caps move fast and dilute quickly if emissions ramp.

Look for delivered milestones. BlockDAG’s V4 dashboard is a concrete example of shipping before listing. That kind of proof lowers uncertainty.

Utility is a safety net. SpacePay’s 0.5% merchant fee and Best Wallet’s early-access feed are tangible signals of real demand—not just promises.

Strategy: sizing, diversification, and exit plans around listings

Size positions with a laddered approach. I enter in tranches and never let one token define my P&L.

- Diversify categories: infrastructure, tools, and culture plays behave differently in market moves.

- Listing-day plan: set profit targets and stop-loss ranges ahead of time to avoid panic trades.

- Security posture: confirm audits, liquidity locks, and multi-sig treasury controls before adding size.

Reliability is earned. Track uptime, bug disclosures, and dev response cadence. If evidence erodes—missed milestones, opaque comms—reduce exposure fast.

“Price whiplash is part of presales; use volatility to scale, not to chase.”

What is the best crypto presale to invest in 2025?

- A strong, transparent team

- Clear utility and real-world use case

- Audited smart contracts

- Backing from reputable launchpads (Binance Launchpad, CoinList, DAO Maker)

- A solid roadmap and active community

If you want, I can show you how to screen 2025 presales so you can identify the most promising ones yourself and avoid scams.

Key Statistics to Track in Crypto Presales (2025)

When analyzing presales, focus on:

- Hard Cap & Soft Cap

- Soft cap = minimum funds needed for the project to launch.

- Hard cap = maximum funds they aim to raise.

- Token Price in Presale vs Launch Price

- Compare early entry price to expected exchange listing price.

- Tokenomics

- Total supply, circulating supply at launch, vesting schedules, and inflation.

- Fundraising Progress

- How much has already been raised, and how quickly.

- Community Size & Engagement

- Number of Telegram, Discord, and Twitter followers (real vs. bots).

- Partnerships & Backers

- Venture capital investors, exchange support, or ecosystem partnerships.

- Use Case & Utility

- Does the token solve a real problem (DeFi, gaming, AI, infrastructure)?

Predictions for 2025: sectors and tokens with breakout potential

Signals stack: a listing window plus real UX traction often precede the largest moves I track.

My call: infrastructure sets the pace early, trader tools capture volatility, and meme phases punctuate the year in short bursts.

Infrastructure leaders vs. trader tools vs. meme cycles

Infrastructure projects with real demos—think BlockDAG’s DAG approach and Bitcoin Hyper’s SVM/ZK L2—have the highest chance of early momentum.

Tools like Snorter and wallets (for example, Best Wallet) profit when user activity spikes. They monetize volume fast if integration and speed hold up.

Meme coin cycles return often. The ones backed by culture engines (Mind of Pepe, Memereum) and staking mechanics—like TOKEN6900—last longer than hype-only clones.

Liquidity, listings, and sentiment as catalysts

Listings on tier-one exchanges amplify moves. Deep liquidity matters more than narratives. Watch CEX announcements and lock schedules.

Sentiment and social velocity are the invisible catalysts. Track on-chain inflows and social spikes together for timing.

- Short-term: infra leads, tools harvest volatility.

- Medium: wallets and integrations compound user growth.

- Long-term: tokens with real utility and fair distribution survive hype cycles.

| Driver | Why it matters | What to watch |

| Listing | Amplifies liquidity | Tier-1 CEX announcements |

| Integration | Locks users in | Wallet bridges, POS, SDKs |

| Sentiment | Timings and runs | Social velocity + on-chain flows |

“Predictions are scenarios, not certainties—discipline wins when conditions change.”

Evidence and sources

Numbers without traceable sources are noise; I cross-check each figure against public contracts and audits.

Source highlights: presale figures, APYs, pricing, tech claims

Key stats come from public disclosures, launchpad summaries, and on‑chain explorers. For example, BlockDAG shows >$364M raised, 24.8B BDAG sold at $0.0016 (locked until Aug 11) with a projected $0.05 listing anchor and a V4 dashboard demo.

Other figures I verified: Bitcoin Hyper (~$6.8M raised; token ~ $0.012525; 153% APY; SVM + ZK rollups), TOKEN6900 (~$1.6M raised of $5M cap; ~$0.006825; ~38% APY), Snorter (>$2.7M; ~$0.1001), Best Wallet (>$13M; ~$0.025255), SpacePay (near ~$1M; ~$0.003181; 0.5% fees; 325+ wallets), and Solaverse (satellite + AI + AR; SolaBridge on Solana).

Notes on incentives: APYs and rewards are presale-stage incentives and may change after listing. Technical claims—DAG concurrency, SVM/ZK rollups, satellite feeds—are cited from project docs and coverage, not promises.

Attribution and time context: present-day data points and updates

All fundraising and price figures reflect the sources available at the time of writing. Where sources differed, I favored corroborated on‑chain numbers or launchpad disclosures.

- Cross-check important figures on the project site, contract explorer, or the tools listed in Section 15.

- Keep a live tracker—allocations and risk posture change when audits, lockups, or listings update.

- If a number shapes your trade thesis, confirm it on the official contract before you act.

“This snapshot is a tool, not a guarantee—verify contracts and watch updates closely.”

Edit

Delete

| Project | Raised | Price | Note |

| BlockDAG | >$364M | $0.0016 | V4 demo; $0.05 anchor |

| Bitcoin Hyper | ~$6.8M | ~$0.012525 | 153% APY; SVM + ZK |

| TOKEN6900 | ~$1.6M | ~$0.006825 | ~38% APY; 32% of cap |

| SpacePay | ~$1M | ~$0.003181 | 0.5% fee; 325+ wallets |

Conclusion

Let’s finish with a short playbook that turns research into repeatable actions.

I recap what mattered: BlockDAG’s V4 demo and scale; Bitcoin Hyper (~$6.8M, 153% APY); Snorter (~$2.7M) as a tools play; TOKEN6900 (~$1.6M) as a culture-led token; Best Wallet (> $13M) for early access; SpacePay (~$1M, 0.5% fee).

My approach is simple. Verify on‑chain stats, map vesting, size entries, and pre-plan exits. Recheck dashboards and official sources before you buy.

Treat eligibility, KYC, allocation, staking, and claim timing as checkpoints. Aim for resilient exposure across infra, tools, and coins. Let data lead decisions, not hype.

Short FAQ note: check platform rules for user limits and claim windows before committing funds.

FAQ

What is presale in cryptocurrency?

A presale in cryptocurrency is an early sale of a project’s tokens to investors before they’re publicly available, often at a discounted price.

What is the focus of this roundup and who is it for?

This roundup targets U.S.-based DIY investors and builders who want an evidence-driven view of current token launches, meme culture projects, infrastructure plays, and tools-first presales. I focus on market signals, tokenomics, staking rewards, launch access, and on-chain metrics so readers can weigh commercial intent, utility, and risk before participating.

How did you select today’s top presales?

I screened projects for on-chain traction, third-party audits, roadmap delivery, distribution fairness, and staking models. Signals included fundraising velocity, liquidity commitments, vesting schedules, audit reports, community metrics, and tool integrations like wallets or bots. I also considered developer activity and real-world payment or API use cases.

What on-chain evidence matters most when evaluating a presale?

Look for verifiable token allocations, vesting contracts, liquidity lock timestamps, audit reports, and meaningful smart contract interactions (transfers, staking, DEX listings). High-quality on-chain dashboards and explorer data reduce reliance on marketing claims and help detect rug-pull patterns early.

How important are audits and KYC for presale safety?

Very important but not sufficient alone. Audits reveal contract-level bugs; KYC increases accountability for teams. Combine both with multisig timelocks, locked liquidity, and independent community scrutiny. I avoid projects that rely solely on “audit coming soon.”

How should I size my allocation and manage risk during presales?

Use position sizing tied to a personal risk budget—small single-digit percentages of your crypto exposure for high-risk presales. Diversify across sectors (infrastructure, tools, meme/community) and set exit plans for listing and post-listing volatility. Expect high variance; treat many presales as experimental bets.

What tokenomics features indicate fair distribution?

Favor clear caps, transparent founder and advisor vesting, reasonable private-sale discounts, and staking that rewards long-term holders. Avoid excessive team allocations, open-ended minting, or opaque treasury controls. Look for on-chain vesting schedules you can verify.

Are staking rewards sustainable when APYs look very high?

Extremely high APYs often rely on token emissions, not native revenue. They can attract short-term speculators and inflate supply. Check emission schedules, utility-driving demand (fees, payments, governance), and reward halving mechanics to assess sustainability.

Which launchpads and platforms offer reliable access?

Reputable launch platforms include CoinList, Binance Launchpad, DAO Maker, TrustPad, and TrustSwap. They tend to run KYC, provide due diligence, and offer allocation controls. Still, perform your own on-chain checks and read platform terms closely before committing funds.

How do I evaluate meme and culture tokens differently from infrastructure projects?

Meme tokens lean on community momentum, virality, and tokenomics like low entry price plus staking or gamified mechanics. Infrastructure plays need tech evidence: testnets, audits, throughput benchmarks, and developer integrations. Treat meme projects as community-driven plays and infrastructure as product-led investments.

What tools help track presale momentum and sentiment?

Use on-chain dashboards, DEX screeners, social sentiment trackers, and bot analytics. Wallet analytics and developer activity feeds (GitHub, testnet commits) also help. I rely on combined signals: fundraising speed, social engagement, and verified on-chain metrics.

How soon should I expect a listing after a presale?

Timing varies widely. Some projects list within days; others take weeks or months due to liquidity provisioning, exchange negotiations, or vesting constraints. Check the presale’s stated listing window and liquidity commitments to set realistic expectations.

What red flags should make me avoid a presale?

Major red flags: anonymous or unverified teams, lack of audits, unlocked large liquidity, disproportionate team allocations, inconsistent roadmaps, unrealistic APY promises, and poor community governance. Any aggressive FOMO marketing without verifiable tech or on-chain proof is suspect.

How do vesting and FDV (fully diluted valuation) affect presale decisions?

Vesting reduces short-term sell pressure when properly scheduled. FDV indicates potential future supply dilution and should be compared to market-competing projects. A low entry price with an astronomical FDV can imply steep dilution risk at listing—factor that into sizing and exit planning.

Can merchant payment and wallet integrations reduce project risk?

Real-world integrations, such as merchant payment rails, Android POS compatibility, or multi-chain wallet partnerships, suggest product-market fit beyond hype. They don’t eliminate risk but provide tangible adoption signals that can support token value over time.

How should U.S. investors approach legal and tax considerations for presales?

Presales can trigger taxable events (airdrops, staking rewards, trades). U.S. investors should keep detailed records, consult a tax advisor, and be mindful of securities laws—especially when projects promise profit-sharing or centralized control. KYC platforms and reputable counsel help reduce regulatory surprises.

What post-purchase steps do you recommend for tracking and securing tokens?

Move tokens to a secure wallet with hardware-wallet options for large holdings. Track vesting schedules, staking dashboards, and DEX liquidity. Use portfolio trackers and set alerts on listing events or contract changes. Regularly review project milestones against the roadmap.

Which sectors look most likely to break out this year?

Infrastructure (scalable L1/L2 solutions), trader tools (bots, analytics), and payments/merchant rails show strong signals. Meme cycles can spike rapidly but are driven by community sentiment. Liquidity, audit-backed tech, and real-world integrations are the likely catalysts for lasting gains.

Where do you source presale figures like fundraising totals and APYs?

I aggregate on-chain explorers, project dashboards, audited reports, launchpad disclosures, and reputable market trackers. Whenever possible I cross-check figures against transaction data and third-party reporting to keep numbers current and verifiable.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe