In 2021, Dogecoin hit an all-time high of $0.74, capturing the attention of investors worldwide. Today, its value hovers around $0.26, leaving many wondering if it can reclaim its former glory. With its roots as a meme coin, Dogecoin has evolved into a serious topic in the crypto world1.

What makes Dogecoin unique is its blend of humor and utility. Unlike Bitcoin or Ethereum, Dogecoin offers faster transaction times and lower fees, making it ideal for small transactions. Its block time is under a minute, a feature that appeals to many users2.

Experts predict Dogecoin could reach $1.3 by 2025, driven by its growing use cases and social media influence. However, its reliance on platforms like Twitter and endorsements from figures like Elon Musk introduces volatility2.

This article dives into the data, exploring graphs, statistics, and expert predictions. Whether you’re a seasoned investor or new to crypto, understanding Dogecoin’s potential is key to making informed decisions.

Key Takeaways

- Dogecoin reached an all-time high of $0.74 in 20211.

- Its current value is around $0.26, sparking debates about its future1.

- Experts predict a potential rise to $1.3 by 20252.

- Dogecoin offers faster transaction times and lower fees compared to Bitcoin2.

- Social media and endorsements play a significant role in its volatility.

Introduction and Background

From internet humor to investor portfolios, Dogecoin’s journey is nothing short of fascinating. What began as a playful joke in 2013 has grown into a cryptocurrency with real-world utility. Its creators, Billy Markus and Jackson Palmer, never imagined their meme-inspired coin would capture the attention of the crypto world.

Origins of Dogecoin and Meme Culture

Dogecoin was born out of the internet’s love for memes, specifically the Shiba Inu dog. Its creators wanted to poke fun at the seriousness of other cryptocurrencies like Bitcoin. Yet, this lighthearted approach resonated with people. The coin’s community embraced its quirky origins, turning it into a symbol of fun and generosity.

Over time, Dogecoin’s meme roots became a strength. Its community-driven ethos and low transaction fees made it stand out. Unlike Bitcoin, which focuses on being a store of value, Dogecoin aimed to be a practical token for everyday use3.

Evolution and Current Market Position

Dogecoin’s transformation from a joke to a market contender is remarkable. In 2021, it reached an all-time high of $0.74, driven by endorsements from figures like Elon Musk and viral trends on social media4. This sudden rise showcased its potential, but also highlighted its volatility.

Today, Dogecoin remains a popular choice among investors. Its price has stabilized around $0.26, with analysts predicting future growth. The coin’s ability to adapt and its strong community support have kept it relevant in the ever-changing crypto market.

For those interested in exploring similar opportunities, alternative assets like Dogs DOGS are gaining attention. These coins, inspired by Dogecoin’s success, are carving their own niche in the cryptocurrency world.

Market Analysis and Investor Sentiment

Analyzing Dogecoin’s price movements reveals a story of volatility and opportunity. Its market trends have always been a rollercoaster, capturing both excitement and skepticism. Recent data shows Dogecoin’s market cap and trading volume are shaping its future5.

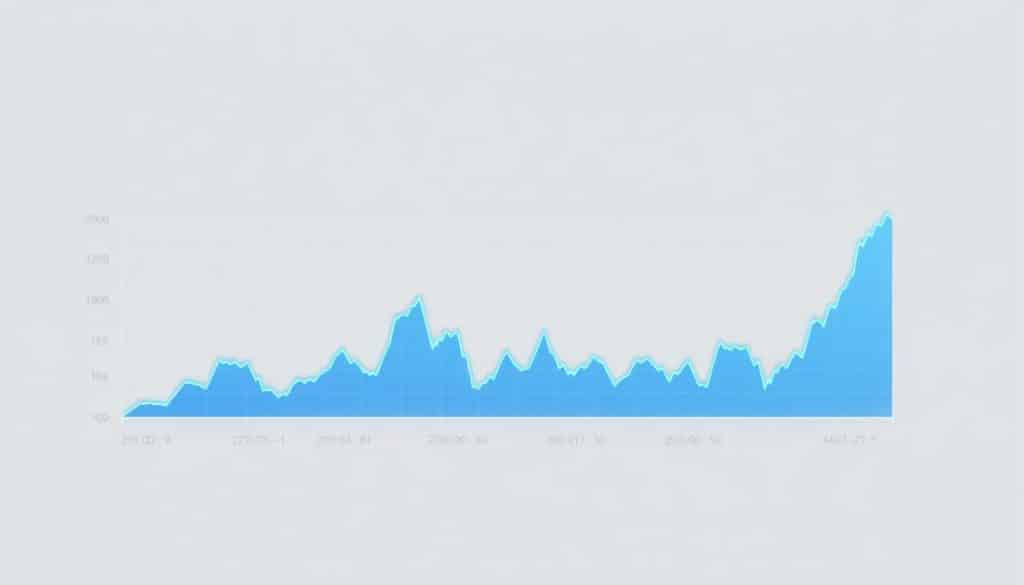

Graphical Data and Statistical Trends

Graphical representations highlight Dogecoin’s price fluctuations over time. In 2021, it surged to an all-time high of $0.74, driven by social media buzz and endorsements2. Since then, its value has stabilized around $0.26, but trading volume remains strong.

Statistical trends suggest a potential upward trajectory. Analysts predict Dogecoin could see significant growth by 2025, with price targets ranging from $1.3 to $102. Its transaction speed and low fees continue to attract users, making it a practical token for everyday use5.

Evidence from Recent Market Movements

Recent market activity shows both bullish and bearish signals. After Donald Trump’s election victory, Dogecoin surged by 145%, showcasing its sensitivity to external events5. However, its reliance on social media and endorsements introduces volatility.

Investor sentiment is heavily influenced by these trends. While some see Dogecoin as a speculative asset, others view it as a viable cryptocurrency with real-world utility. Combining charts with qualitative evidence provides a robust analysis of its potential6.

can dogecoin reach $1

Dogecoin’s future price trajectory sparks debates among investors and analysts alike. With its current value hovering around $0.26, many wonder if it can achieve the elusive $1 mark. Let’s dive into the price predictions, forecast models, and expert tools that could shed light on this possibility.

Price Predictions and Forecast Models

Forecast models offer varying insights into Dogecoin’s potential. According to CoinCodex’s machine learning algorithm, Dogecoin could hit $1 by March 20257. This prediction hinges on substantial market capitalization growth and broader adoption. However, conservative estimates from CoinPriceForecast suggest a more modest $0.1228 by the end of 20258.

Heuristic models also play a role in these predictions. They analyze historical data, trading volume, and social media influence to project future trends. For instance, Dogecoin’s sensitivity to endorsements from figures like Elon Musk has historically driven its price surges1.

Tools and Expert Analysis for Investors

For investors, tools like CoinCodex and Polymarket provide valuable insights. CoinCodex’s machine learning models predict a $1.04 price by March 2025, while Polymarket assigns a 22% chance of Dogecoin hitting a new all-time high by June 20258.

Analysts emphasize the importance of monitoring trading volume and market sentiment. Recent surges, like the 145% increase following Donald Trump’s election victory, highlight Dogecoin’s volatility1. Tools that track these patterns can help investors make informed decisions.

From my experience, combining these tools with a balanced view of risks and rewards is crucial. While the potential for a $1 price tag exists, it’s essential to consider the market’s unpredictability and external influences.

Regulatory Influences and Supply Considerations

Regulatory changes and token supply dynamics play a pivotal role in shaping Dogecoin’s future. From executive orders to political shifts, these factors can significantly impact its price and long-term value. Understanding these elements is crucial for any investor navigating the crypto landscape.

Impact of Token Supply and Inflation on Value

Dogecoin’s unfixed supply is a double-edged sword. Approximately 14.4 million new tokens are mined daily, contributing to inflation9. This continuous influx can suppress price growth, especially when demand remains steady or declines. Unlike Bitcoin, which has a capped supply, Dogecoin’s model introduces unique challenges.

Inflation mechanics directly affect the market. As more tokens enter circulation, their individual value may decrease. This dynamic contrasts with assets like Bitcoin, where scarcity drives value10. For Dogecoin, this means that even with growing adoption, its price may face upward resistance.

| Cryptocurrency | Supply Model | Daily Mined Tokens |

|---|---|---|

| Dogecoin | Unfixed | 14.4 million |

| Bitcoin | Fixed (21 million) | 900 |

Regulatory developments also play a critical role. For instance, New York State Senator James Sanders Jr. introduced a bill to explore the status of crypto, which could influence future policies11. Such measures can indirectly shape investor sentiment, either boosting confidence or introducing uncertainty.

From my experience, the interplay between supply and regulation is complex. While Dogecoin’s community-driven ethos remains a strength, its unfixed supply and regulatory risks require careful consideration. Looking ahead, these factors will likely continue to shape its trajectory in the crypto market.

Community and Celebrity Impact on Dogecoin

The rise of Dogecoin is deeply tied to its vibrant community and celebrity endorsements. From its meme origins to its current market position, the coin’s journey has been shaped by the enthusiasm of its supporters and the influence of high-profile figures.

Influence of High-Profile Endorsements

Celebrity endorsements have been a driving force behind Dogecoin’s price surges. Elon Musk’s tweets, for instance, have repeatedly sparked viral discussions and trading spikes. His humorous analogies, like calling Dogecoin the “people’s crypto,” have elevated its cultural status12.

Other public figures have also contributed to its popularity. When companies like Tesla and AMC Theaters began accepting Dogecoin, it signaled growing business adoption. These endorsements not only boost market perception but also attract new investors12.

Role of Social Media and Public Sentiment

Social media platforms have been instrumental in shaping Dogecoin’s trajectory. Trends on Twitter and Reddit often translate into investor mood and trading activity. For example, bullish social media data has historically correlated with price surges13.

The community’s active engagement, from tipping to charitable causes, has also strengthened its brand recognition. This grassroots support has turned Dogecoin from a niche token into a global phenomenon12.

“Dogecoin’s success is a testament to the power of community and viral news.”

| Cryptocurrency | Social Media-Driven Surges | Key Influencers |

|---|---|---|

| Dogecoin | 145% after Trump’s election victory | Elon Musk, Mark Cuban |

| Bitcoin | 20% after institutional endorsements | Michael Saylor, Cathie Wood |

From my experience, the interplay between celebrity endorsements and social media trends is both a strength and a vulnerability. While it drives short-term gains, the long-term sustainability of such influence remains uncertain. For those exploring innovative decentralized commerce models, understanding these dynamics is crucial.

Conclusion

The journey of this meme-inspired token has been both unpredictable and intriguing. From its all-time high of $0.74 in 2021 to its current price of around $0.26, its story is a mix of volatility and potential1.

Experts predict growth, with some models suggesting a rise to $1.3 by 20252. However, factors like unfixed supply and regulatory changes introduce risks. The market remains sensitive to endorsements and social media trends, making it a high-risk, high-reward asset.

From my experience, tools like CoinCodex and Polymarket offer valuable insights for navigating this space. While the hype is undeniable, informed decision-making is crucial. The interplay of community support, crypto adoption, and external influences will shape its future.

Stay updated with the latest news and use data-backed analysis to make strategic moves. The crypto world is unpredictable, but understanding these dynamics can help you stay ahead.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe