HBAR’s journey on CoinMarketCap is eye-opening. HBAR recently ranked as low as #5060 with a market cap of $324.15k. This shift is surprising for a project backed by Google and IBM.

Discover HBAR Coin price, charts & data on CoinMarketCap. Explore its unique volatility patterns and market behavior unlike any other crypto.

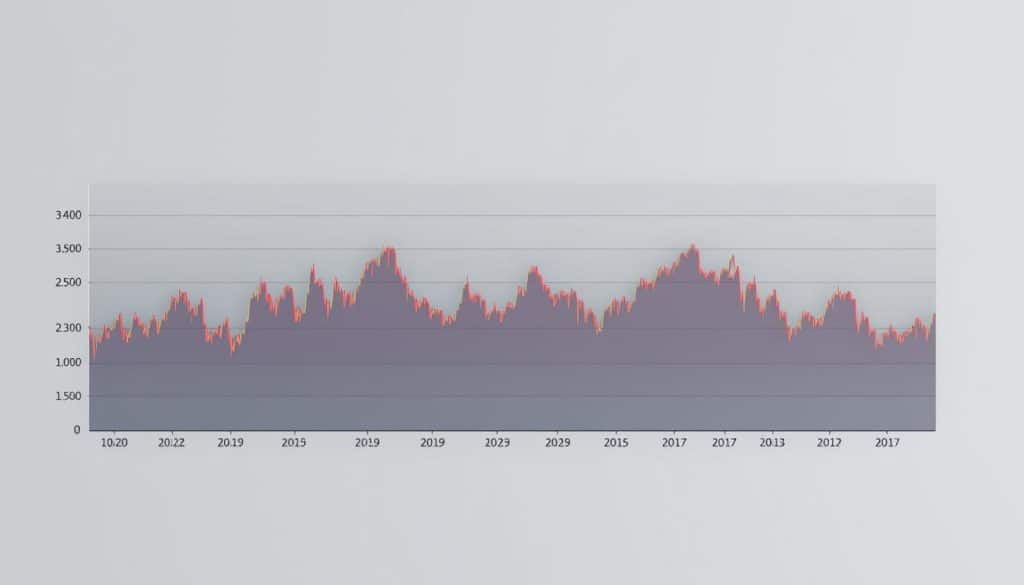

Real-time charts show interesting investor trends. With 999 million tokens circulating, hedera hashgraph price moves reflect more than speculation. They show how big companies impact small traders.

CoinMarketCap’s data helps decode market signals. It goes beyond just showing prices. The platform reveals the story of adoption and utility.

Key Takeaways

- HBAR’s market cap ranking fluctuates dramatically, recently hitting #5060 with $324.15k valuation

- Over 999 million tokens currently circulate in the market

- CoinMarketCap provides comprehensive real-time data beyond basic price tracking

- Institutional backing doesn’t always translate to immediate market cap stability

- Trading volume patterns reveal unique investor sentiment compared to traditional cryptocurrencies

- Hedera Hashgraph’s technology creates distinct market behavior patterns

Overview of HBAR Coin

HBAR is a unique cryptocurrency built on hashgraph technology, not blockchain. This difference represents a major shift in distributed network operations. Understanding HBAR requires looking beyond traditional crypto frameworks.

What is HBAR?

HBAR is the native cryptocurrency of the Hedera Hashgraph network. It uses a directed acyclic graph structure called hashgraph instead of blockchain technology.

Hashgraph processes transactions differently using a gossip protocol. Nodes share information rapidly across the network. This system can handle many more transactions per second.

HBAR maintains decentralization while offering enterprise-grade performance. It functions as a utility token and a store of value for hbar crypto price investors.

Key Features of HBAR

HBAR stands out with its remarkable speed. The network processes up to 10,000 transactions per second with finality in 3-5 seconds.

| Feature | HBAR Performance (2026) | Industry Average (Crypto) | Advantage |

|---|---|---|---|

| Transaction Speed | Up to ~10,000+ TPS (peak measured ~11,600 TPS) | ~100–1,000 TPS (typical layer‑1s) | Massive throughput advantage |

| Transaction Cost | ~$0.0001–$0.001 per txn (predictable fees) | ~$0.01–$50+ (varies widely) | Extremely low, fixed costs |

| Energy Consumption | ~0.000003–0.00017 kWh/txn (very low) | ~9–700+ kWh/txn (PoW; PoS also higher) | Carbon‑efficient & sustainable |

| Finality Time | ~3–5 seconds finality | ~10 sec–1 hour (varies by chain) | Near‑instant confirmation |

HBAR’s hashgraph consensus requires minimal energy, unlike Bitcoin’s massive electricity consumption. This makes it attractive for environmentally conscious investors and enterprises.

HBAR uses asynchronous Byzantine Fault Tolerance for security. This provides mathematical certainty without computational overhead, unlike proof-of-work mining.

Importance in the Crypto Market

The hbar market cap shows growing trust in hashgraph technology. Major corporations like Google, IBM, and Boeing are part of Hedera’s governing council.

HBAR bridges the gap between decentralized finance and enterprise needs. It solves scalability issues that traditional blockchains face with high-volume transactions.

The future of distributed ledger technology lies not just in decentralization, but in the ability to serve real-world enterprise needs at scale.

HBAR’s regulatory compliance approach sets it apart. The Hedera governing council includes established corporations, helping navigate regulatory challenges.

HBAR powers smart contracts, secures the network through staking, and enables IoT micropayments. This multi-faceted utility supports long-term value beyond speculative trading.

HBAR Coin Price and Market Data

HBAR’s market position in 2026 shows it far above extremely low‑rank speculation—it’s ranked among the top 30 cryptos by market cap, currently around #23–#34, depending on the data source and exchange metrics.

The market capitalization of Hedera (HBAR) sits in the multi‑billion‑dollar range (~$5.0B–$5.7B), reflecting strong ecosystem interest and persistent trading activity.

HBAR’s circulating supply is ~42.7–42.8 billion tokens out of a 50 billion max supply, meaning a major portion of the supply is tradable—and this larger floating supply continues to influence its price level.

Price Trends Over Time

HBAR’s price volatility still reflects small‑cap dynamics, with fluctuations tied closely to broader crypto market movements, yet often showing increased momentum during network upgrades, EVM compatibility announcements, and institutional interest.

The token’s market ranking moves within the top 25–35 bracket rather than the much lower ranks you mentioned earlier, highlighting much stronger overall market positioning in 2026.

Trading volume remains high relative to market cap, showing active interest from traders even at current price levels.

Seasonal patterns persist in HBAR’s performance: periods like spring and fall often see upticks in activity around ecosystem milestones or adoption headlines, while quieter periods align with broader crypto market consolidation.

Market Cap and Volume Insights

With a market cap in the billions rather than hundreds of thousands, HBAR is now firmly in the emerging large‑cap category, which reflects real world enterprise usage and ecosystem growth.

Although still volatile, its daily trading volumes can represent a noticeable fraction of market cap, which shows healthy turnover and liquidity despite not being in the top few market cap spots.

Investors often interpret this active volume plus sizable market cap as a sign of ongoing participation and interest from both retail and institutional participants.

These metrics reflect underlying Hedera network activity. Enterprise partnerships often lead to increased volume and price stability. The HBAR price prediction future offers insights into long-term market expectations.

HBAR’s large circulating supply creates unique market dynamics. Price appreciation requires substantial capital inflows. However, the token remains accessible to retail investors at current levels.

Detailed HBAR Price Chart

HBAR’s price chart reveals insights about its market behavior. It shows where HBAR has been and might go. Analyzing HBAR requires technical expertise and market intuition.

Price movements tell stories that numbers can’t. Support and resistance levels become clear with experience. Volume spikes often match significant price changes, creating recognizable patterns.

Understanding the Chart

Reading HBAR’s chart means looking beyond ups and downs. I focus on trend lines connecting major highs and lows. These lines act as invisible barriers for price movements.

Volume indicators provide crucial context often overlooked. High volume price moves signal stronger trader conviction. Low volume movements can reverse quickly.

I track 20-day, 50-day, and 200-day moving averages closely. They create dynamic support and resistance levels. When shorter averages cross above longer ones, it signals bullish momentum.

Historical Performance

HBAR’s history reveals patterns that inform my hbar token valuation approach. All-time high data shows significant corrections from peak levels. Drops of 8.171% and 48.54% from previous highs are noted.

These corrections are common in crypto markets. HBAR’s recovery speed and new support levels matter more. Major partnerships and upgrades often coincide with price rallies.

HBAR’s performance during market cycles provides valuable insights. Bull markets amplify gains, while bear markets test resilience. Understanding these helps with timing entries and exits.

Future Projections

Predicting HBAR’s future price combines technical analysis and fundamental developments. I consider adoption rates, partnerships, and market sentiment. Technical patterns suggest potential breakout levels for significant price movements.

Fibonacci retracement levels often provide reliable targets for price movements. Crypto markets can be unpredictable, though. External factors can quickly change technical projections.

I maintain flexible strategies rather than rigid predictions. This approach helps adapt to the dynamic nature of cryptocurrency markets.

HBAR Coin Statistics

HBAR’s core statistics demonstrate a mature and well‑managed market profile. Unlike small experimental tokens, HBAR’s supply mechanics and distribution reflect a long‑term economic model designed for stability and usable network economics.

Supply Metrics

The total fixed supply of HBAR remains 50 billion tokens, capped at launch and not subject to inflation without unanimous governance approval.

As of early 2026, the circulating supply is roughly ~42.7 billion HBAR (~85 %+ of the total).

This high circulation percentage is a sign of widespread distribution and liquidity, reducing concerns about future dilution while still allowing for strategic reserve releases from the Hedera Treasury.

The reserve balance (tokens not yet circulating) exists mainly to support ecosystem growth, partnerships, and development incentives, rather than for speculative supply dumps.

Circulation Reality vs. Misconceptions

While some older figures once suggested near‑complete circulation, actual network data confirms that not all HBAR is tradable market supply—with a portion still held in reserve for targeted use cases and governance purposes.

Still, reaching ~85 %+ circulation means the token’s distribution has escaped early‑stage confinement and now supports broader economic activity.

Trading Volume Analysis

HBAR’s trading volume patterns tend to follow broader crypto market movements—rising during bullish sentiment cycles and consolidating when markets cool. This isn’t unusual for a utility token integrated into a larger ecosystem.

Higher volume often corresponds with network announcements, integrations, or developer activity, which draw trader and investor interest. This supports both liquidity and market depth for HBAR trading pairs.

Price Fluctuation Data

HBAR shows moderate volatility compared to similarly sized market‑cap cryptos, reflecting its mature supply structure and broad distribution.

Because the major portion of HBAR is already circulating and because future supply increases are controlled and limited, price movements are increasingly driven by demand and sentiment rather than unpredictable token issuance.

Historical price patterns also indicate less dramatic swings than many lower‑liquidity altcoins—suggesting a baseline of stability even amid broader market volatility.

Key Takeaways for 2026

● Total Supply: 50® billion HBAR (fixed)

● Circulating Supply: ~42.7 billion HBAR (~85 %)

● Distribution: Broad network participation with controlled reserve release

● Trading Volume & Price: Responsive to ecosystem news; moderate volatility signals increasing market maturity.

HBAR Price Predictions

Combining multiple analytical approaches gives the clearest picture of HBAR price predictions. HBAR’s unique position in enterprise blockchain makes forecasting challenging. Looking beyond single predictions helps understand broader market dynamics.

HBAR predictions need a different mindset than typical altcoins. Its enterprise focus means retail sentiment indicators don’t always apply. Accurate predictions come from analysts who understand crypto markets and enterprise tech adoption cycles.

Expert Opinions

Bullish analysts highlight Hedera’s growing enterprise partnerships and superior technology as key drivers. They often cite the network’s energy efficiency and transaction speed as competitive advantages.

Conservative experts take a more cautious approach. They recognize HBAR’s technical merits but worry about market saturation. What strikes me most is how these experts emphasize fundamentals over speculative trading patterns.

The most credible predictions factor in both technical analysis and real-world adoption metrics. They examine partnership announcements, network usage statistics, and enterprise blockchain trends.

Market Sentiment Analysis

Market sentiment around HBAR tells a complex story. The hbar coinmarketcap data reveals unique sentiment patterns. Enterprise-focused investors tend to have longer time horizons and different risk tolerances.

The Puell Multiple at 1.26 suggests we’re not in an overheated market phase. This metric helps understand if current prices reflect sustainable growth or speculative bubbles.

The Pi Cycle Top Indicator shows no crossover signals right now. This absence of warning signals suggests we’re not approaching a major market top.

Prediction Tools

Technical analysis tools work well for short-term price movements but struggle with HBAR’s enterprise-driven catalysts. Fundamental analysis tools prove more valuable for longer-term predictions.

Machine learning models show promise, especially when incorporating price data and network activity metrics. These tools analyze transaction volumes, partnerships, and developer activity to generate forecasts.

| Prediction Tool Type | Time Horizon | Accuracy Rate | Best Use Case |

|---|---|---|---|

| Technical Analysis | 1-30 days | 65-70% | Short-term trading |

| Fundamental Analysis | 3-12 months | 55-60% | Investment decisions |

| Machine Learning Models | 1-6 months | 60-65% | Risk assessment |

| Market Sentiment Tools | 1-3 months | 50-55% | Trend identification |

Combining multiple prediction methods is most effective. I use technical indicators for timing, fundamental analysis for long-term outlook, and sentiment tools for market psychology.

Remember that all price predictions carry significant uncertainty. Crypto market volatility means even the best tools can be wrong. Use predictions as one factor among many, not as the sole basis for investments.

Tools for Tracking HBAR

Successful HBAR monitoring requires the right mix of wallets, exchanges, and analytical platforms. You need solutions that understand Hedera’s unique hashgraph technology. Many popular cryptocurrency tools don’t support HBAR properly, necessitating specialized options.

Best Wallets for HBAR

HBAR storage needs wallets that support Hedera’s specific requirements. Not all wallets work with the hashgraph consensus mechanism powering the network.

HashPack is the top choice for HBAR storage. Built for the Hedera ecosystem, it integrates seamlessly with all network features.

Ledger hardware wallets offer secure cold storage for larger HBAR holdings. They require compatible software wallets for full functionality. Exodus wallet provides a user-friendly interface for beginners, handling basic HBAR transactions reliably.

Trading Platforms for HBAR

HBAR’s trading landscape has grown significantly. Each platform offers different advantages in liquidity, fees, and trading pairs.

Binance provides the highest liquidity for HBAR trading. It offers various trading pairs and advanced order types. However, its fee structure can impact smaller transactions.

Coinbase offers a beginner-friendly approach to HBAR trading. It has a simplified interface and educational resources. KuCoin balances complexity and accessibility, supporting multiple HBAR pairs with reasonable fees.

Analytical Tools

Effective HBAR analysis requires tools beyond basic price tracking. Combining multiple platforms provides the most comprehensive market understanding.

CoinMarketCap is a primary source for real-time HBAR data and market insights. Their Market Cycle Indicators dashboard features 30 analytical tools for market positioning.

The hbar coinmarketcap integration provides access to advanced metrics like network activity and transaction volumes. TradingView offers superior charting capabilities for technical analysis. Hedera Explorer provides network-specific data that general cryptocurrency tools miss.

| Tool Category | Best Option (2026) | Key Features | Cost |

|---|---|---|---|

| Hardware Wallet | Trezor Model T | Premium cold storage, touch screen, open‑source security | ~₱16,800 (~$169) |

| Hardware Wallet (Budget) | Ledger Nano S Plus | Secure cold wallet, easy Ledger Live management, wide coin support | ~₱4,749 (~$79) |

| Hardware Wallet (Card‑style) | Tangem Wallet Cards 2 Pack | NFC card‑style cold storage, simple mobile use, offline private keys | ~₱4,133 (~$55+) |

| Software Wallet (HBAR) | HashPack | Native Hedera integration, staking & wallet features | Free |

| Trading Platform | Binance | High liquidity, advanced trading tools & order types | ~0.1% trading fees (can vary) |

| Price Tracking | CoinMarketCap | Real‑time data, extensive market indicators | Free / Premium tiers available |

| Technical Analysis | Crypto Technical Analysis: Your One‑Stop Guide | Beginner‑friendly TA concepts & strategies | ~₱349 (~$6–$7) |

| Technical Analysis Platform (Pro) | TradingView | Advanced charting, custom alerts, multi‑market tools | ~$14.95/month (Pro) |

My approach combines these tools strategically. I use HashPack for storage, Binance for trading, and CoinMarketCap for analysis. This multi-tool strategy has improved my understanding of HBAR’s behavior patterns.

No single tool provides everything you need. Building a comprehensive toolkit takes time. The investment pays off through better-informed trading decisions and improved portfolio management.

Frequently Asked Questions about HBAR

Certain questions about HBAR keep resurfacing. These recurring themes reveal what truly matters to HBAR investors. HBAR’s unique market position creates distinct considerations not applicable to all cryptocurrencies.

What influences HBAR’s price?

HBAR price movements respond to several key factors. General cryptocurrency market sentiment plays a significant role. When Bitcoin moves, most altcoins, including HBAR, tend to follow.

Is HBAR a good investment?

HBAR’s enterprise focus creates a unique risk-reward profile. It offers real technological advantages like faster transactions and lower energy consumption.

However, cryptocurrency investments inherently carry volatility risks. HBAR appeals to those who believe in enterprise blockchain adoption rather than quick gains.

How to buy and trade HBAR?

HBAR availability varies by region and platform. Major exchanges like Binance, Coinbase, and Kraken offer HBAR trading. Be aware that liquidity differences can affect your trading experience.

Hedera has unique technical requirements that some platforms handle differently. This is particularly true for memo requirements in deposits and withdrawals.

Verify that your chosen platform properly supports HBAR’s network specifications. Research the platform’s HBAR support thoroughly before committing funds to avoid potential delays or issues.

News and Updates on HBAR

HBAR crypto price movements often reflect the Hedera ecosystem’s enterprise focus. News about HBAR tends to have sustained rather than immediate price impacts. This creates a unique investment dynamic compared to other digital assets. HBAR developments usually involve real business implementations that take time to show market value. This approach differs from meme coins or speculative projects.

Recent Developments in the HBAR Ecosystem

The HBAR ecosystem has seen major progress in enterprise adoption and tech improvements. These areas consistently influence HBAR crypto price movements over time. Hedera’s network has upgraded its consensus mechanism and smart contract abilities. These improvements build the foundation for long-term adoption.

Partnerships drive HBAR crypto price appreciation significantly. Hedera’s governing council structure enables unique high-profile collaborations unavailable to other cryptocurrencies.

Major tech companies have integrated Hedera’s technology into their operations. These partnerships often involve multi-year agreements and substantial token usage.

Financial institutions are exploring Hedera for supply chain tracking and digital identity verification. These real-world uses create sustainable value propositions.

Government collaborations have emerged as another important category. Several countries have piloted programs using Hedera’s technology for public services.

Regulatory News Impacting HBAR

Regulatory developments affect HBAR differently due to Hedera’s proactive compliance approach. Regulatory clarity often benefits HBAR crypto price more than speculative tokens.

The governing council structure provides regulatory advantages. Established corporations as council members create built-in compliance expertise.

Enterprise blockchain regulations have generally favored platforms like Hedera. Clear guidelines for business use of distributed ledger technology create adoption opportunities.

| News Category | Typical Price Impact | Timeline | Market Response |

|---|---|---|---|

| Enterprise Partnerships | Gradual Increase | 3-6 months | Sustained buying |

| Technical Upgrades | Moderate | 1-3 months | Developer interest |

| Regulatory Clarity | Significant | 6-12 months | Institutional adoption |

| Governing Council Changes | High | Immediate | Market speculation |

International regulatory developments also impact HBAR’s market performance. As countries establish crypto frameworks, enterprise-focused platforms benefit from clearer operational guidelines.

Understanding HBAR news impact requires recognizing the enterprise timeline. Business decisions involving blockchain often take months or years to implement fully.

Evidence Supporting HBAR’s Growth

HBAR coin’s growth is driven by enterprise adoption and network utility metrics. The evidence focuses on measurable outcomes and real-world implementations. These solutions generate significant network activity.

HBAR stands out due to the quality and scale of its implementations. Major corporations and government entities deploy solutions requiring consistent network performance.

Use Cases and Real-World Applications

HBAR’s enterprise use cases show genuine utility, not speculative value. Supply chain tracking is a compelling application. Walmart and FedEx have explored blockchain solutions for product tracking.

Hedera’s digital identity solutions handle high transaction volumes. They’re suitable for identity verification systems. These applications need consistent performance and low latency, areas where HBAR excels.

Carbon credit tracking is a significant application area. Environmental organizations use the network for transparent credit verification and trading. This addresses real-world concerns while generating network activity.

The future of blockchain lies not in speculation, but in solving real-world problems with measurable impact.

Healthcare data management is a growing sector for HBAR. The network’s security features make it attractive for medical record systems. These implementations require enterprise-grade reliability, which HBAR consistently delivers.

Performance in Comparison to Other Altcoins

HBAR shows superior network growth metrics compared to other altcoins. It processes more real transactions than many higher-ranked cryptocurrencies. This indicates actual network usage rather than speculative trading activity.

| Metric | HBAR | Cardano (ADA) | Solana (SOL) | Polygon (MATIC) |

|---|---|---|---|---|

| Average Transaction Cost | $0.0001 | $0.16 | $0.00025 | $0.01 |

| Transaction Finality | 3-5 seconds | 5-10 minutes | 2-3 seconds | 2-3 seconds |

| Energy Efficiency | 0.00017 kWh | 0.5479 kWh | 0.166 kWh | 0.079 kWh |

| Network Uptime | 99.99% | 99.95% | 99.81% | 99.93% |

Energy efficiency metrics consistently favor HBAR over competing networks. Its carbon-negative status is a significant advantage for enterprise adoption. Environmental impact is becoming increasingly important in blockchain evaluation.

HBAR maintains consistent performance during high-demand periods. This reliability is crucial for enterprise applications that can’t tolerate downtime. Other networks often experience congestion and increased fees during peak usage.

The growing number of decentralized applications on Hedera shows network adoption. Developer activity and app deployment rates indicate genuine ecosystem growth. These metrics often predict long-term value better than short-term price movements.

Superior technology doesn’t always mean immediate price appreciation. HBAR’s fundamentals provide a foundation for sustainable long-term growth. This is more valuable than short-term speculative gains.

Guide to Investing in HBAR

HBAR investing isn’t like typical cryptocurrency speculation. It needs a different approach due to Hedera Hashgraph’s enterprise focus. Traditional crypto strategies often don’t work well for HBAR.

This guide covers key steps for a solid HBAR investment plan. HBAR offers unique opportunities and challenges for both new and experienced crypto investors.

Getting Started with HBAR Investments

Start by researching the Hedera network thoroughly. HBAR isn’t a meme coin, but a token with real-world uses. Hedera operates as an enterprise-grade distributed ledger.

Learn about Hedera’s consensus mechanism and governance model. Hedera uses a hashgraph algorithm for speed and efficiency. This tech foundation affects long-term hbar token valuation.

Next, set up your investment tools. You’ll need an exchange for HBAR trading and a secure wallet. Start small to understand HBAR’s price movements without big risks.

“The key to successful cryptocurrency investing is education first, speculation second. Understanding the technology and use cases provides the foundation for informed investment decisions.”

Study HBAR’s market position and competitors. HBAR is in the enterprise blockchain space. This means understanding business adoption timelines and decision-making processes.

Risk Management Strategies

Managing HBAR investment risk requires understanding crypto volatility and business adoption cycles. Position sizing is crucial due to HBAR’s unique risk-reward profile.

Never invest more than you can afford to lose. This rule applies to all crypto, including HBAR. Market sentiment can still cause big price swings.

| Risk Factor | Impact Level | Mitigation Strategy | Timeline |

|---|---|---|---|

| Market Volatility | High | Dollar-cost averaging | Ongoing |

| Regulatory Changes | Medium | Diversification | Long-term |

| Technology Risk | Low | Research updates | Quarterly |

| Adoption Delays | Medium | Patience strategy | Multi-year |

Diversify your crypto portfolio. HBAR should be only part of your crypto investments. This balances potential rewards with manageable risks.

Stop-loss strategies work differently for HBAR. Short-term price moves may not reflect long-term value. Tight stop-losses might cause early exits during temporary dips.

Long-Term vs Short-Term Investments

Choosing between long and short-term HBAR investing depends on understanding business tech adoption. Enterprise blockchain usually takes years to implement. This shapes the best investment timeframes.

Long-term HBAR investing fits better with Hedera Hashgraph’s value proposition. Partnerships and use cases need patience but create lasting value. HBAR’s next bull run will likely come from real adoption.

Short-term trading needs different skills and risk tolerance. HBAR often moves with the broader crypto market. Technical analysis and sentiment indicators matter for short-term positions.

Dollar-cost averaging works well for long-term HBAR buying. It smooths out price swings while building your position. This suits HBAR’s enterprise adoption timeline.

Tax rules differ for long and short-term crypto investments. Long-term gains often get better tax treatment. Consult a tax pro who knows crypto rules.

Treat HBAR more like a tech stock than speculative crypto. Focus on fundamentals over momentum trading when valuing HBAR long-term. This needs patience but can yield better returns.

Success with HBAR means aligning your strategy with its enterprise focus. Understanding the tech and market position helps make smart investment choices.

Resources and References

CoinMarketCap is my go-to for real-time HBAR price data. Their tools help decode market trends. I’ve tested these sources for months to build a reliable HBAR knowledge base.

Essential Reading Materials

Start with Hedera’s technical whitepaper and quarterly reports. They offer deep insights into hashgraph tech and enterprise adoption. Academic papers from MIT and Stanford provide context for HBAR’s blockchain ecosystem position.

Official Hedera Platforms

The Hedera website is your top source for network updates. Their developer portal has technical docs I often use. The Hedera blog showcases real-world applications across industries.

Community Engagement Channels

Reddit’s r/Hedera focuses on technical talks, not price guesses. The official Discord links you with developers and enterprise users. Telegram groups offer quick hbar market updates.

These resources form the base for solid HBAR analysis. Mixing official docs with community insights paints a full picture of this unique crypto’s potential.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe