Technical analysis is a cornerstone of crypto trading. It helps traders make better decisions by examining past market data. This practice aims to forecast future prices by identifying trends and patterns. Unlike fundamental analysis, which looks at the intrinsic value of an asset, technical analysis focuses on charts and metrics. This article will look at how to use technical analysis.

Use the Right Tools and Platforms

Having the right tools matters for technical analysis. Different platforms have charts, indicators and other tools to help make smart choices. These can be simple and free or more advanced and paid.

When you choose a platform, find one with clear charts and easy-to-use controls. A good platform should have many tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). These features should be simple for beginners to use.

Like with online gambling sites where you put your money, it is key to watch out for security. Only get software from sources you trust. Some sites also have learning guides on how to use their tools. This help can be very useful to learn quickly.

You need to keep up with new tools in the market. The world of crypto changes fast. New tools often have better features that help you do better analysis.

Price Trends and Patterns

Price moves form the heart of technical analysis. Traders look at old price moves to guess future ones. They try to find trends, which show where a market is heading. Trends can go up, down or stay flat.

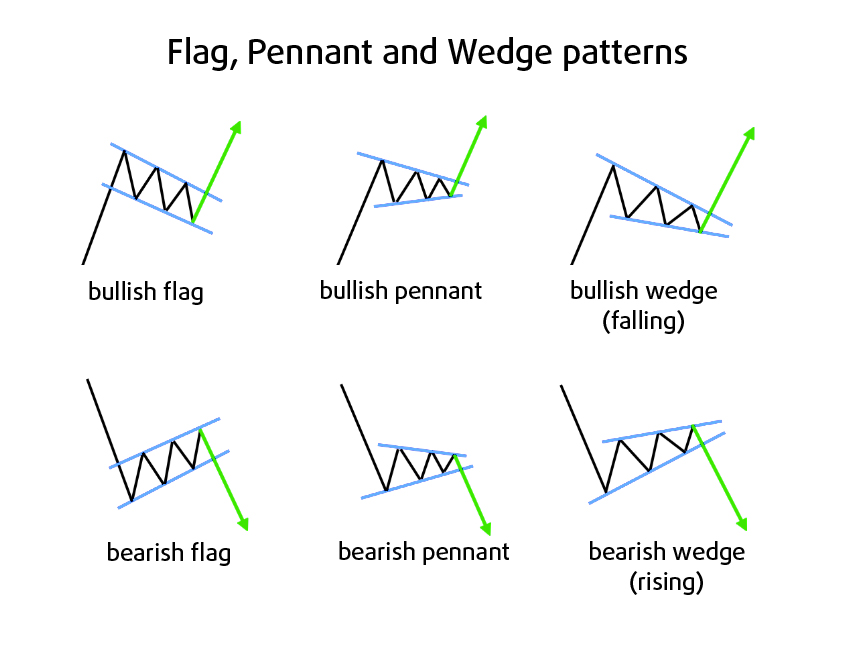

Patterns on price charts also play a key role. Some common patterns include:

- Head and shoulders. Indicates potential trend reversal.

- Double top and bottom. Suggests changes in price direction.

- Flags and pennants. Shows short-term continuation of existing trends.

- Triangles. Signals possible breakouts either upward or downward.

- Cup and handle. Shows potential bullish move after a consolidation phase.

- Wedges (rising or falling).Points to likely reversal in the current trend.

- Channels (ascending or descending).Provides clear indications of support and resistance levels.

Learning to read these patterns helps traders see how the market moves. This skill lets them find chances early. Many traders use candlestick charts for this, as they show more details than simple line charts.

Indicators

Indicators help traders understand market direction. They use math and past data to find patterns. Some indicators work best in trends. Others suit markets without any clear direction. Here’s a list of key indicators:

- Moving averages. These show the average price over a set time. The two main types are Simple Moving Average (SMA) and Exponential Moving Average (EMA). SMA takes the average of a given period. EMA gives more weight to recent prices.

- Relative strength index (RSI). RSI measures speed and change of price movements. Values range from 0 to 100. An RSI above 70 may mean a market is overbought. Below 30 means it is oversold.

- Moving average convergence divergence (MACD). MACD shows the relationship between two moving averages of a security’s price. It helps identify changes in trend strength, direction, duration and momentum.

- Bollinger bands. Bollinger Bands consist of three lines. The middle line is usually an SMA. the outer bands are standard deviations away from it. It shows volatility and possible price levels for trades.

- Fibonacci retracement levels. This tool uses horizontal lines to show possible support and resistance levels. These lines are based on Fibonacci ratios (23.6%, 38.2%, 50%, 61.8% and 100%).

- Stochastic oscillator. This compares a specific closing price to a range of prices over time. The values also range from 0-100. Readings above 80 often indicate overbought conditions. Below 20 indicates oversold conditions.

Volume Analysis

This type of analysis is a key part of crypto trading. It shows how much of a coin people have traded over time. High volume means lots of interest in that coin. Low volume can point to less interest.

Traders watch for spikes in volume. A quick rise can show a new trend or lots of market activity. When prices go up with high volume, it shows strong buying and backs a bullish outlook. When prices fall with high volume, it can mean a strong bearish trend. Such analysis helps check trends on price charts. If you see a price breakout with high volume, the move is more likely to be real and not fake.

Looking at trading volume now and comparing it to past numbers can give helpful insights. If it’s higher today than the average of recent days or weeks, the market might be changing. So, it all helps in making decisions based on price moves.

Final Words

Technical analysis is vital in crypto trading. Tools and platforms are crucial. Learn to read trends, patterns, and key indicators. Volume analysis shows market interest. Keep practising for better decisions. Stay updated with new tools and methods, and your skills will improve over time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe