MicroStrategy’s stock (MSTR) has soared in 2023, increasing more than sixfold. This incredible growth has turned 마이크로스트레티지 주가 into a hot investment topic.

The company’s bold Bitcoin investment strategy has been revolutionary. MicroStrategy now owns 423,650 bitcoins, recently adding 149,880 in four transactions.

With a market cap of about $90 billion, MicroStrategy leads in cryptocurrency investment. Their inclusion in the Nasdaq 100 index boosts visibility.

The Invesco QQQ Trust will now automatically buy MicroStrategy shares. This adds more momentum to the company’s impressive stock performance.

Key Takeaways

- MicroStrategy’s stock has surged more than sixfold in 2023

- The company owns 423,650 bitcoins

- Market capitalization stands at approximately $90 billion

- Nasdaq 100 index inclusion provides additional stock boost

- Bitcoin investment strategy has been pivotal to growth

Understanding 마이크로스트레티지’s Business Model

마이크로스트레티지 blends traditional business intelligence with innovative cryptocurrency strategies. Their unique approach sets them apart from typical tech companies. With a $120.977 billion market cap, they’re a major player in technology and investments.

Core Business Offerings

The company’s main focus is business intelligence software. They offer advanced analytics solutions for enterprises.

- Enterprise analytics platforms

- Data visualization tools

- Intelligent reporting systems

Innovative Market Strategy

마이크로스트레티지 stands out with its bold cryptocurrency approach. They’ve made significant Bitcoin investments, challenging traditional corporate financial strategies.

Their recent purchase of 16,130 BTC at $36,785 each shows their commitment to digital assets. This move reflects an innovative trend in the industry.

Competitive Market Position

The company uniquely combines software expertise with cryptocurrency investment. This creates a distinctive value proposition in the market. Their stock performance reflects this strategy, ranging from $32.33 to $283.19 over 52 weeks.

| Key Metric | Value |

|---|---|

| Market Cap | $120.977 billion |

| PE Ratio (TTM) | 407.10 |

| Price Target | $266 – $304 |

마이크로스트레티지 offers a unique blend of software and cryptocurrency investment opportunities. This approach makes them stand out in both tech and digital asset spaces12.

Recent Performance of 마이크로스트레티지 주가

마이크로스트레티지 주가’s recent performance shows a wild ride of ups and downs. The stock’s big swings reflect the company’s daring move into cryptocurrency3. This bold strategy has caught the eye of many investors.

Remarkable Stock Price Movements

The 주식 차트 reveals some eye-popping trends. Since May’s lows, the stock has surged an impressive 142%4. This growth outpaces the Nasdaq’s 26.81% gain4.

On August 3, the stock price hit $324.554. Earlier in January, it reached a yearly high of $6853.

- Stock price surged to $324.55 on August 34

- Outperformed Nasdaq’s gains of 26.81%4

- Reached a yearly high of $685 in January3

Crucial Financial Metrics

주식 뉴스 shows some tough financial numbers. In Q2, the company lost a billion dollars4. This included a $917.84 million loss from its Bitcoin holdings4.

Despite these hurdles, key financial metrics tell an interesting story:

Strategic Bitcoin Investment Impact

MicroStrategy’s unique strategy continues to captivate investors. The company now holds nearly 190,000 BTC3. Their total purchases have jumped by 41.6%3.

This bold move sets the stock apart in tech and crypto circles4. It’s a gamble that’s keeping everyone on their toes.

The anticipated Bitcoin halving event in April 2024 could potentially trigger a bullish market phase3.

Statistical Insights into 마이크로스트레티지 주가

Let’s explore 마이크로스트레티지’s key financial indicators. These reveal the company’s market performance. Investors can gain valuable insights into the stock’s valuation.

Here are the main financial metrics that showcase the company’s market position:

- Market Capitalization: Approximately $80.311 billion5

- Enterprise Value: $78.83 billion5

- Bitcoin Holdings: 152,333 BTC, valued at roughly $4.5 billion6

Current Stock Price Analysis

The stock’s performance offers fascinating insights into its valuation. Its previous close was $275.15, with a trading range of $271.77 to $311.285. This shows notable volatility.

The company’s unique approach to cryptocurrency investment makes it stand out. It differs significantly from traditional tech stocks.

Investment Return Comparisons

The financial metrics are particularly intriguing for investors. The stock trades at a 60-162% premium compared to its net asset value6.

Key performance indicators include:

A critical observation is the company’s strategic positioning in the Bitcoin market. MicroStrategy uses a leverage long strategy on Bitcoin. It holds significant Bitcoin amounts.

This unique investment approach sets it apart from traditional tech companies6.

The future looks promising, with Bitcoin market projections suggesting potential growth to $4 trillion by late 20256.

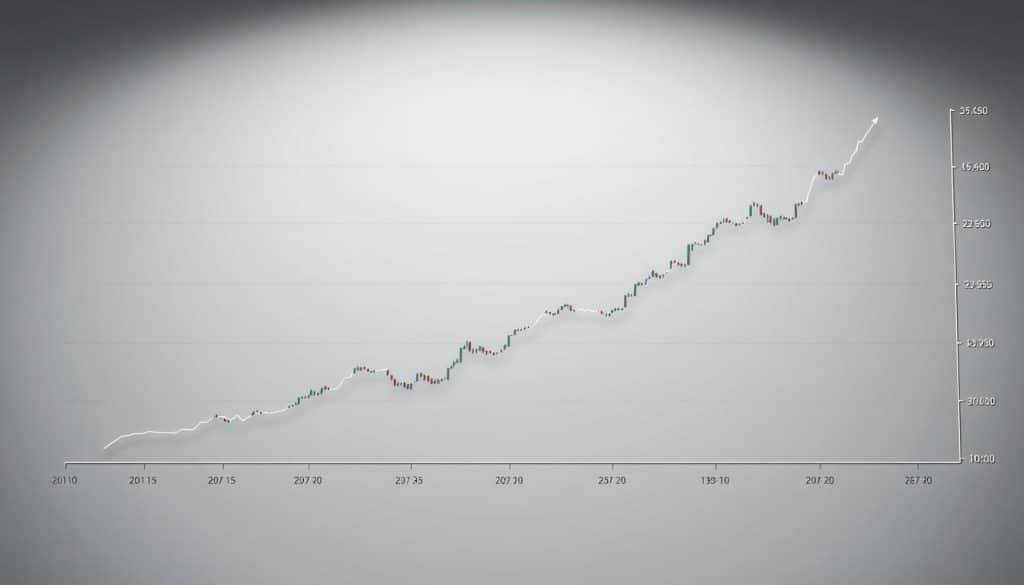

Graphical Analysis of 마이크로스트레티지 주가

주식 차트 analysis offers key insights into stock performance. Visual data helps decode market movements and reveal hidden trends. These insights go beyond what numbers alone can show.

마이크로스트레티지’s stock 기술 분석 shows interesting patterns over time. Investors can learn a lot by looking at important numbers:

- 52-week price range: $13.98 – $66.917

- Current market capitalization: $42.608 billion7

- Average daily trading volume: 27,668,575 shares7

Visualizing Stock Trends

To understand stock behavior, we need to study price movements closely. The stock’s beta of 2.14 shows high volatility. This means it could bring bigger returns, but also more risk7.

Significant Price Fluctuations

| Metric | Value |

|---|---|

| 1-Year Target Estimate | $68.817 |

| Trailing P/E Ratio | 29.607 |

| Profit Margin | 47.81%7 |

Following these graph indicators helps investors make smart choices. They can better decide when to buy or sell 마이크로스트레티지’s stock7.

Predictions for 마이크로스트레티지 주가

Stock investments require careful analysis and strategic insight. The 마이크로스트레티지 주가 offers an interesting opportunity for tech-driven market investors. It’s worth exploring market trends to develop effective 투자 전략.

Analysts have been tracking the stock’s performance closely. They’ve noted some compelling indicators that suggest potential growth.

- The stock has surged 220.64% year-to-date8

- Current market capitalization stands at $80.311 billion5

- 1-Year target estimate reaches $513.015

Forecasting Future Performance

Experts predict potential volatility in 마이크로스트레티지 주가. The Relative Strength Index (RSI) is just above 70, hinting at possible overvaluation8.

The stock’s beta of 3.37 shows significant market sensitivity5. This factor should be considered when making investment decisions.

Analyst Opinions and Price Targets

Investment professionals have mixed views on 주식 뉴스 for this stock. Some warn of a potential correction in the near future.

Others see continued growth potential. They point to technological innovations and strategic positioning as key drivers.

| Metric | Value |

|---|---|

| Forward P/E Ratio | 3.185 |

| Enterprise Value | $78.83 billion5 |

| Year-to-Date Performance | 220.64%8 |

Investors should approach this stock with cautious optimism. Comprehensive research and understanding of market dynamics are crucial for success.

Tools for Analyzing 마이크로스트레티지 주가

Stock analysis requires powerful tools and strategic insights. Investors need a comprehensive approach to 투자 전략. This approach combines cutting-edge technology with precise 기술 분석.

Yahoo Finance is a key resource for tracking MicroStrategy’s stock. It offers robust features for informed decision-making9.

Essential Financial Platforms

- Yahoo Finance: Provides comprehensive real-time stock data9

- Interactive Charts: Visualize stock performance trends9

- Price Movement Alerts: Set notifications for critical updates9

Key Metrics for Investors

Successful investing requires understanding critical metrics. Investors should focus on:

- Market capitalization

- Trading volume

- 52-week price range9

Experts suggest using multiple sources to confirm data accuracy. Yahoo Finance’s interactive features enable detailed 기술 분석.

These tools help investors develop strong 투자 전략. Smart use of technology transforms raw data into actionable insights.

Smart investors leverage technology to transform raw data into actionable investment insights.

Mastering financial platforms can boost your investment approach. These tools equip you to navigate MicroStrategy’s stock performance effectively9.

Frequently Asked Questions about 마이크로스트레티지 주가

Tracking 마이크로스트레티지’s stock can be tricky in the complex 주식 시장. Let’s explore key questions investors often have about this unique company’s performance.

What Drives Stock Price Fluctuations?

Several factors influence 마이크로스트레티지 주가 in today’s market. Bitcoin price changes greatly affect the stock. The company’s financial choices also play a role.

Tech sector performance and economic trends in crypto investments are important too. MicroStrategy’s finances show $38.12 million in cash and $7.26 billion in debt10.

- Bitcoin price movements significantly impact the stock10

- Company’s strategic financial decisions

- Overall technology sector performance

- Macroeconomic trends affecting cryptocurrency investments

How to Interpret Recent Market Trends?

Recent data reveals interesting patterns for investors. The stock dropped 30% last month, while Bitcoin rose 10%10. This shows the complex link between crypto values and stock performance.

MicroStrategy plans to raise $2 billion for more Bitcoin purchases10. They’ve also suggested adding 10 billion new authorized shares. These moves could change the stock’s future path.

Understanding market trends requires careful analysis and a nuanced approach to investment research.

Analysts’ price targets range from $90 to $1,000 per share10. Investors should research thoroughly and consider various viewpoints before making decisions.

Evidence Supporting Investment Decisions

Exploring 투자 전략 requires careful study of real-world investment scenarios. Successful investors know that 기업 분석 goes beyond surface-level research. It demands a deep dive into proven strategies and expert insights.

Let’s look at some case studies that show the power of strategic investment approaches.

- A notable investor spotted MicroStrategy’s unique position in the tech market7. The company has a $42.608 billion market cap and a 47.81% profit margin7.

- Financial experts highlight the company’s robust financial metrics:

Insights from Market Analysis

Strategic investors recognize the importance of comprehensive 기업 분석. The stock’s performance reveals critical insights:

“Understanding a company’s financial details is key to making smart investment choices.” – Financial Analyst

Recent market data shows:

- 52-Week Price Range: $13.98 – $66.917

- 1-Year Target Estimate: $68.817

- Average Trading Volume: 27,668,575 shares7

Expert-Recommended Investment Approaches

Successful 투자 전략 requires a multi-faceted approach. Investors should look at financial metrics, growth potential, and market position.

- Detailed financial metric analysis

- Long-term growth potential

- Market positioning and competitive landscape

The data shows that careful, informed decisions can unlock big investment opportunities. This dynamic market offers potential for those who do their homework.

Reliable Sources for Ongoing Updates

Navigating the complex world of 주식 뉴스 requires strategic information gathering. Investors need accurate market insights to make informed decisions. Identifying credible sources with deep, analytical coverage is crucial11.

Tracking 산업 동향 calls for a multi-channel approach. Professional investors use financial platforms that offer real-time market data. Sources like Bloomberg and Reuters provide critical updates on market movements11.

Digital platforms have transformed investment research. SeekingAlpha, Fintech blogs, and investment podcasts offer unique perspectives. A diverse information ecosystem helps investors make better choices11.

Continuous learning is key for strategic investors. Attending webinars and following respected analysts can provide valuable market intelligence. Successful investors stay curious and well-informed about emerging trends11.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe