Solana launchpads have changed how crypto projects get funds and build communities in 2025. They use Solana’s fast transactions and low fees. This makes them a great choice over Ethereum-based options.

If you’re starting a project or want to invest early, knowing Solana launchpads is key. This guide will show you the best ones. We’ll look at their features, security, and how users feel.

You’ll learn how these platforms work and what makes them special. By the end, you’ll know how to explore this exciting part of the crypto world confidently.

What Are Solana Launchpads and Why They Matter

Solana launchpads help new crypto projects start on the Solana blockchain. They connect creators with investors. This makes it easier for projects to sell tokens, build communities, and provide liquidity.

Launchpads are different from old ways of raising money. They use blockchain’s ideas in a new way. Projects can share tokens fairly and investors get them early. This can be very valuable before they are widely available.

Key Benefits of Solana Launchpads

For Project Creators

- Access to established investor communities

- Technical infrastructure for token creation and distribution

- Marketing support and visibility

- Liquidity provision mechanisms

- Credibility through platform vetting processes

For Investors

- Early access to promising projects

- Reduced risk through platform due diligence

- Simplified participation process

- Potential for higher returns on investment

- Community engagement opportunities

The Solana blockchain is great for launchpads. It’s faster than other networks. It can handle up to 65,000 transactions per second.

Fees are very low, usually less than $0.01. This makes launching tokens easy and cheap. It avoids the problems seen on Ethereum.

How Solana Launchpads Work

Learning about Solana launchpads is key for creators and investors. Each platform has its own way, but they share some basics. Let’s dive into how they work.

The Launchpad Process

- First, projects apply to launchpads. They check the team, token details, plans, and tech readiness. This is the first step.

- After approval, projects make tokens and smart contracts. These are for the sale. They make sure everything is safe and works right.

- Then, projects market themselves to grow their community. They want people to know about them before the sale.

- Next, investors sign up for whitelists. They need to prove who they are and might have to stake tokens. This is to make sure only real people can buy.

- The sale happens next. It’s in rounds, with different levels for those who staked more. This makes it fair for everyone.

- After the sale, tokens are given to buyers. Sometimes, they can’t sell right away. This helps keep the market stable.

- Finally, some funds and tokens go into liquidity pools. These pools help with trading on decentralized exchanges. It makes everything run smoothly.

Participation Models

Solana launchpads employ various models to determine investor allocation and participation rights:

| Model | Description | Advantages | Disadvantages |

| Lottery System | Random selection of participants from qualified whitelist | Equal opportunity for all participants | Uncertainty of allocation |

| Guaranteed Allocation | Tiered system based on staking amount | Predictable allocation amounts | Favors larger stakeholders |

| First-Come-First-Served | Allocation based on order of participation | Simple and transparent | Can lead to gas wars and network congestion |

| Hybrid Approaches | Combination of multiple models | Balances fairness and reward for loyalty | Can be complex to understand |

Top 5 Solana Launchpads in 2025

After looking at how well they do, what users say, and how many projects succeed, we found the top five Solana launchpads for 2025. Each one has special benefits for different projects and investors.

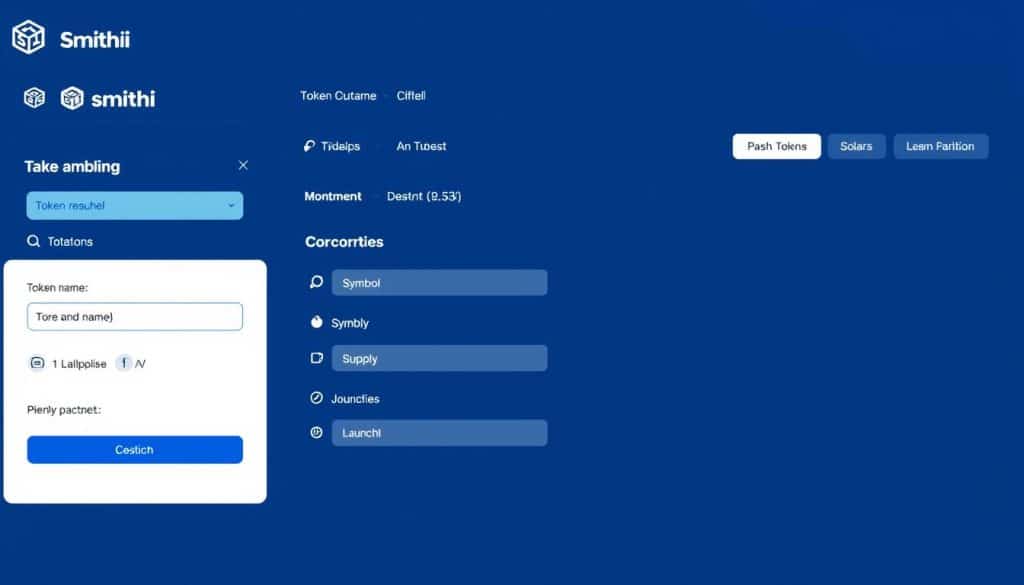

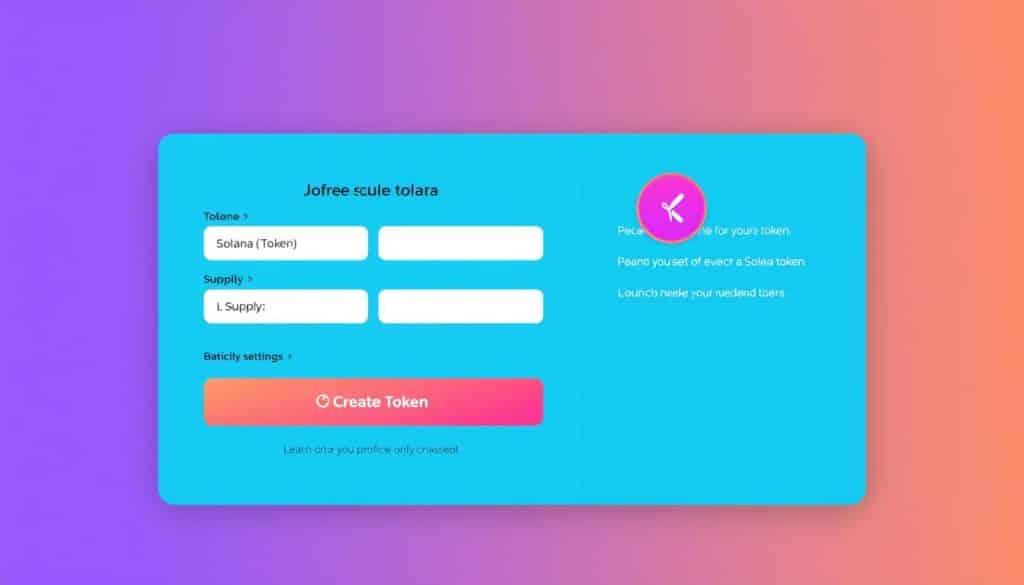

1. Smithii

No-Code Solution Solana ExclusiveSmithii is special. It’s made just for Solana. It lets anyone make and start tokens, even if they don’t know much tech.

This makes it perfect for both newbies and teams that already know what they’re doing. It’s easy to use.

Key Features

- Complete token creation with just 0.1 SOL

- Four-step guided launch process

- Whitelist creation and management

- Tiered pricing options

- Multisender support for token distribution

- CoinFabrik-audited smart contracts

Pros

- Extremely user-friendly interface

- Low entry cost

- Solana-specific optimizations

- Comprehensive token creation tools

Cons

- Limited to Solana blockchain only

- Fewer marketing features than some competitors

- Non-mandatory KYC may concern some investors

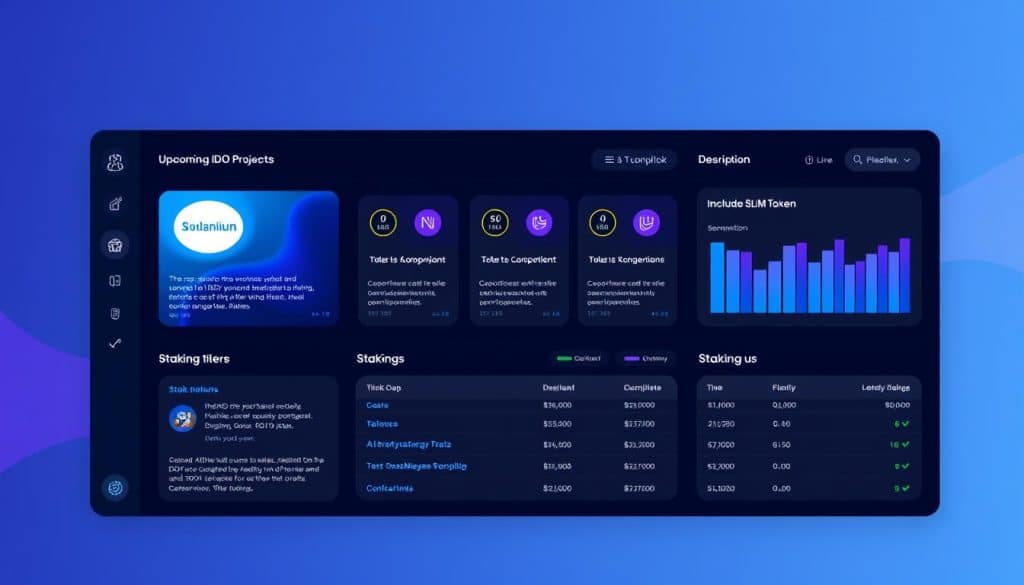

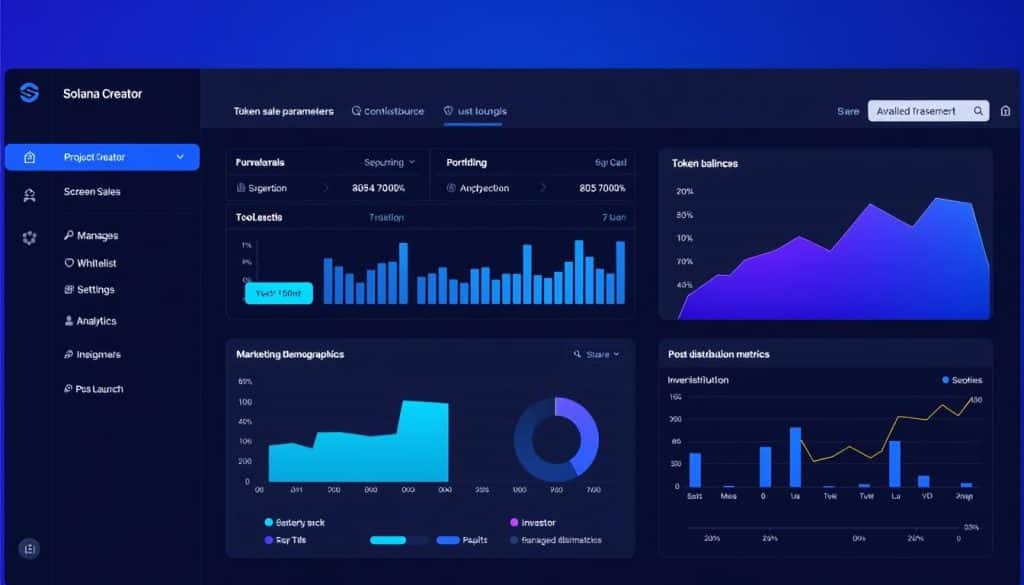

2. Solanium

DeFi Focus Strong VettingSolanium is a top Solana launchpad. It focuses on DeFi, NFT, and GameFi projects. It has a full platform for projects and investors.

It includes token sales, staking, and a native DEX. This makes a complete ecosystem for everyone involved.

Key Features

- Tiered staking system with $SLIM token

- Rigorous project vetting process

- Integrated DEX for immediate trading

- Vesting schedule management

- Project analytics dashboard

- Governance mechanisms

Pros

- High-quality project curation

- Strong security measures

- Active community support

- Comprehensive post-launch tools

Cons

- Higher barrier to entry for small investors

- Competitive allocation process

- Requires significant $SLIM staking for best tiers

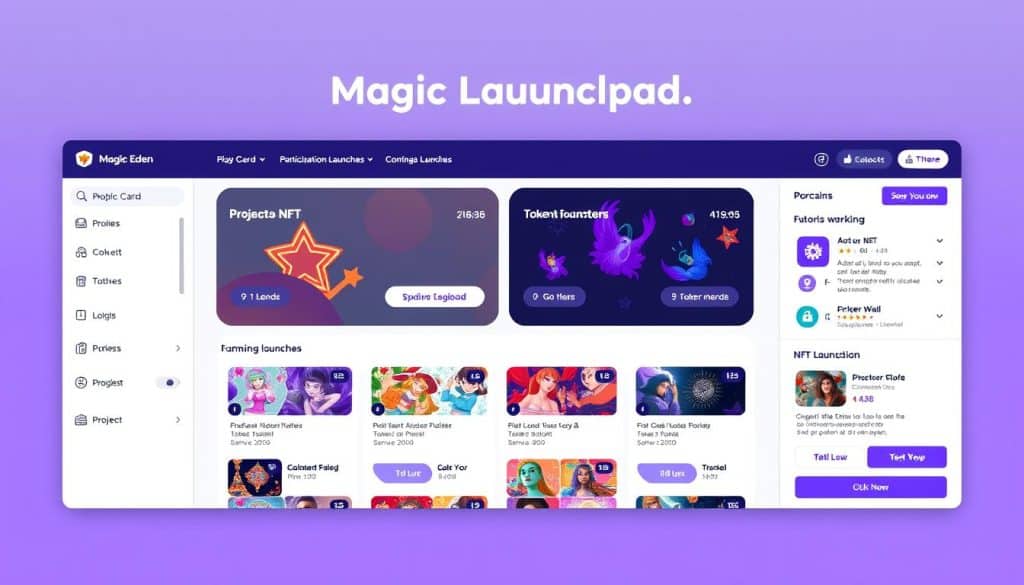

3. Magic Eden Launchpad

Magic Eden is a big name in the world of NFTs. It started with NFTs and now helps with token launches too. It has a huge user base and strong marketing support.

It’s not just for NFTs anymore. Magic Eden also helps with token launches. This means it supports both NFT and token projects.

Key Features

- Combined NFT and token launch capabilities

- Access to Magic Eden’s large user community

- Multi-chain support (Solana, Ethereum, others)

- Comprehensive marketing assistance

- Post-launch trading support

- Advanced analytics and reporting

Pros

- Massive built-in audience

- Strong brand recognition

- Excellent marketing reach

- Seamless NFT integration

Cons

- Highly selective project acceptance

- Higher fees than some competitors

- Less focus on pure token projects

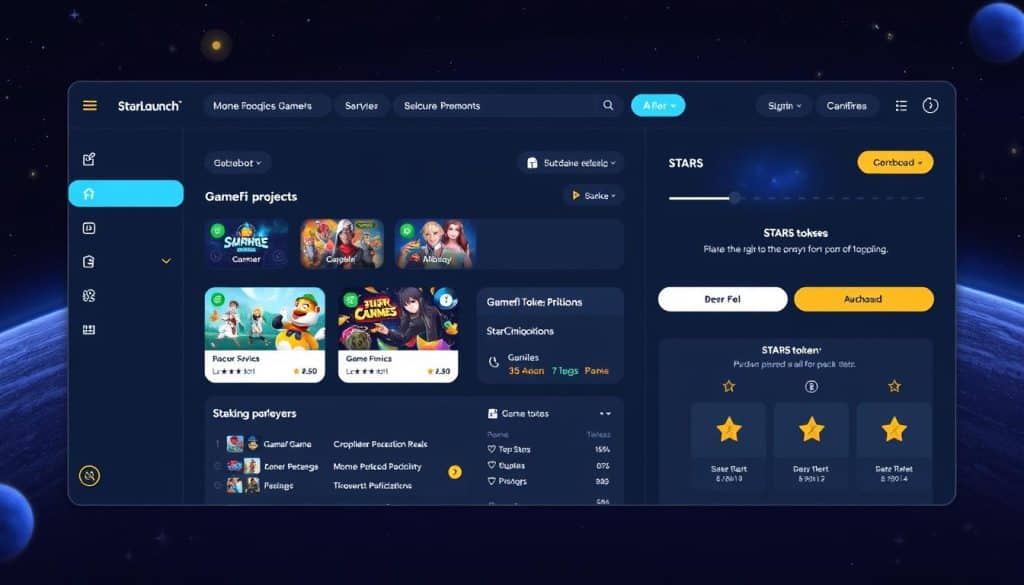

4. StarLaunch

GameFi Focus Investor ProtectionStarLaunch is the top choice for GameFi projects on Solana. It has a special SAFU protocol for keeping investors safe. It also has fun staking mechanics.

Key Features

- SAFU protocol for investor protection

- Dual-token system (STARS and vSTARS)

- Mission-based staking mechanics

- Anti-whale measures

- GameFi project specialization

- Cross-chain expansion capabilities

Pros

- Strong focus on investor security

- Innovative staking approach

- Expertise in gaming projects

- Fair distribution mechanisms

Cons

- Complex dual-token system

- Limited non-gaming projects

- Smaller overall project volume

5. Pump.fun

High VolumePump.fun is all about being quick and easy. It lets anyone make and start Solana tokens in seconds. This makes it great for meme coins and new projects.

Key Features

- One-click token creation

- Automatic liquidity locking

- No code required

- Massive trading volume

- Fair launch mechanism

- Minimal setup requirements

Pros

- Extremely fast and simple to use

- Low barrier to entry

- Built-in security features

- High liquidity and trading volume

Cons

- Limited project vetting

- Higher risk of low-quality projects

- Fewer advanced features

- Less suitable for serious long-term projects

Comprehensive Comparison of Solana Launchpads

When picking a Solana launchpad, it’s important to think about what matters most. We’ve made a list to help you pick the best one for your project. This list looks at important things like fees, support, and how easy it is to use.

| Platform | Best For | Token Required | KYC Required | Ease of Use | Project Vetting | Post-Launch Support |

| Smithii | First-time creators, Memecoins | No | Optional | Very High | Moderate | Good |

| Solanium | DeFi, GameFi, Serious projects | Yes ($SLIM) | Yes | High | Very High | Excellent |

| Magic Eden | NFT projects, High-visibility launches | No | Yes | High | Very High | Excellent |

| StarLaunch | GameFi, Security-focused projects | Yes (STARS) | Yes | Medium | High | Good |

| Pump.fun | Memecoins, Experimental tokens | No | No | Very High | Low | Limited |

Not Sure Which Launchpad Is Right For You?

Our detailed comparison guide breaks down each platform’s strengths and ideal use cases to help you make an informed decision.

How to Participate in a Solana Launchpad

Want to start a project or invest in new ones? Solana launchpads are a great place to begin. Here’s a simple guide to help you get started.

For Project Creators

-

Choose the Right Launchpad: Pick a platform that fits your project. It should match your goals and skills.

- Prepare Required Documentation: Develop a whitepaper, tokenomics model, roadmap, and team information.

- Apply for Listing: Submit your application through the launchpad’s project submission process.

- Complete Due Diligence: Work with the launchpad team to complete any required audits or security checks.

- Set Launch Parameters: Define token price, sale allocation, vesting schedules, and liquidity provisions.

- Engage in Marketing: Collaborate with the launchpad on promotional activities and community building.

- Execute the Token Sale: Launch your token according to the platform’s process.

- Manage Post-Launch Activities: Handle token distribution, liquidity provision, and ongoing development.

For Investors

- Set Up a Solana Wallet: Create and fund a compatible wallet like Phantom, Solflare, or Backpack.

-

Research Available Launchpads: Look at different platforms. Check their project quality, what you need to do, and how they’ve done in the past.

- Complete Registration: Sign up on your chosen launchpad and complete any KYC requirements.

-

Acquire and Stake Platform Tokens: If needed, buy and stake the launchpad’s token. This helps you qualify for special allocations.

- Research Upcoming Projects: Thoroughly evaluate projects before committing funds.

- Register for Whitelists: Apply for participation in projects that interest you.

- Participate in Token Sales: Follow the platform’s process to contribute funds during the sale period.

- Claim and Manage Tokens: After the sale, claim your tokens and decide on your holding strategy.

Security Tip

Always verify the official URLs of launchpads before connecting your wallet. Scam sites mimicking popular platforms are common in the crypto space. Look for secure connections (https://) and check official social media channels for legitimate links.

Success Stories from Solana Launchpads

Several notable projects have launched through Solana launchpads. They show how these platforms can help new ideas grow. These ideas then become big in the crypto world.

Star Atlas (Solanium)

This big metaverse game made over $20 million with Solanium. It’s one of the top Solana IDOs. The game got a lot of help from Solanium’s investors and marketing team. This helped it become well-known before it even started.

Key Achievement: Reached a peak market cap of over $200 million and established itself as a leading GameFi project on Solana.

Samoyedcoin (Pump.fun)

Launched as Solana’s ambassador meme coin, SAMO used Pump.fun’s simple launch mechanics. This helped create a community-driven token. It went beyond typical meme coin status to become a recognized part of the Solana ecosystem.

Key Achievement: Built a community of over 100,000 holders. It also established educational initiatives. These initiatives help with Solana adoption.

Genopets (StarLaunch)

This game was launched through StarLaunch and raised a lot of money. It also built a strong community. StarLaunch helped a lot with its GameFi knowledge and safety for investors.

Key Achievement: Got more money from investors after a great start. It also started a new kind of game on Solana called “move-to-earn”.

What Makes a Successful Launch?

The top Solana launchpad projects have a few things in common. They have strong technical bases and clear uses. Their teams are open and their communities are active.

They also plan well for after the launch. And they pick launchpads that fit their project and audience well.

Risks and Considerations

While Solana launchpads offer exciting opportunities, they also come with significant risks. All participants should understand these risks before getting involved.

Common Risks in Launchpad Participation

For Project Creators

- Platform Dependency: Relying on the launchpad’s reputation and systems

- Market Timing: Launching during unfavorable market conditions

- Community Expectations: Managing investor demands and expectations

- Technical Challenges: Potential smart contract vulnerabilities or integration issues

- Regulatory Uncertainty: Navigating evolving crypto regulations

For Investors

- Project Failure: High percentage of crypto projects ultimately fail

- Token Devaluation: Price drops after initial hype subsides

- Rug Pulls: Fraudulent projects that abandon development after raising funds

- Vesting Lockups: Inability to sell tokens during market peaks due to vesting

- Platform Security: Risks associated with the launchpad itself

Due Diligence Checklist

Before participating in any Solana launchpad as either a creator or investor, consider these essential due diligence steps:

- Verify the launchpad’s track record and security history

- Research the team behind both the launchpad and individual projects

- Examine smart contract audits and security measures

- Analyze tokenomics and vesting schedules for sustainability

- Evaluate the project’s roadmap and technical feasibility

- Check community sentiment across social channels

- Understand all fees, requirements, and potential limitations

Future Trends in Solana Launchpads

The Solana launchpad ecosystem is growing fast. It has new trends that will change it a lot in the next few years.

Emerging Developments to Watch

Enhanced Security Measures

As the ecosystem matures, launchpads are implementing more sophisticated security features, including:

- Mandatory smart contract audits

- Multi-signature treasury management

- Decentralized governance for project approvals

- Advanced anti-bot and anti-manipulation systems

Cross-Chain Integration

Many Solana launchpads are expanding to support multiple blockchains, offering:

- Multi-chain token launches

- Cross-chain liquidity solutions

- Interoperability with Ethereum, BNB Chain, and others

- Unified interfaces for managing assets across networks

Specialized Launchpads

The market is seeing increased specialization with platforms focusing on:

- Industry-specific launches (GameFi, DeFi, etc.)

- Regional or community-focused platforms

- Institutional-grade offerings with enhanced compliance

- Retail-friendly platforms with simplified processes

“The future of Solana launchpads is bright. They will be more secure and easy to use. They will also be made for specific needs and keep up with new rules. This way, they will still offer the freedom of decentralization.”

— Anatoly Yakovenko, Co-founder of Solana

Key Solana Launchpads in 2025

As of October 2025, Solana launchpads are key in the blockchain world. They help new projects start. This is very important for the blockchain ecosystem.

Here’s an overview of key developments:

Pump.fun

- Dominates the meme coin sector, processing approximately 90% of Solana token deployments.

- Cumulative revenue exceeds $700 million since inception.

- Achieved daily revenues of $1.35 million in August 2025, despite market fluctuations.

Solanium

- Specializes in DeFi and GameFi projects.

- Notable for its fair launch mechanisms and community engagement.

Magic Eden

- Leading platform for NFT launches on Solana.

- Offers a comprehensive suite for creators and collectors.

StarLaunch

- Focuses on vetted projects, ensuring higher quality and investor confidence.

- Emphasizes transparency and due diligence in its offerings.

Market Activity and Trends

Revenue Growth: Solana DApps made a big jump in the first half of 2025. They earned $1.6 billion, up from $400 million the year before.

Memecoin Dominance: Now, 62% of Solana DApps’ money comes from memecoins. This shows a big following and support from the community.

Launchpad Token Market Capitalization: In May 2025, the value of Solana launchpad tokens went up by 60% in just seven days. This shows more people want to invest.

Future Outlook

Solana launchpads are key to the blockchain world in 2025. They drive new ideas and bring people together. Sites like Pump.fun and Solanium are at the forefront.

Magic Eden and StarLaunch also play big roles. They help many different projects. This shows how vital these platforms are in the crypto world.

Frequently Asked Questions

What makes Solana launchpads different from Ethereum launchpads?

Solana launchpads have lower fees, often under $0.01. Ethereum’s fees are $10-50. Solana is also faster, with 400ms confirmation times versus Ethereum’s 15 seconds.

They can handle more transactions, 65,000 TPS compared to Ethereum’s 15 TPS. This makes Solana great for launching tokens. It offers a smoother experience without the problems Ethereum faces.

How much capital do I need to participate in Solana launchpad token sales?

How much you need varies by platform. Some, like Pump.fun, start at $10-50. Others, like Solanium, might ask for $200-2,000+ in platform tokens.

You also need to invest in the token itself. This usually costs $100-1,000 for regular investors.

Do I need technical knowledge to launch a token on Solana?

No, you don’t need to know how to code. Platforms like Smithii and Pump.fun have easy-to-use interfaces. You can set up your token without needing to know about blockchain.

But, knowing a bit about tokenomics can help make your token last longer.

Are KYC requirements common on Solana launchpads?

KYC rules differ by platform. Some, like Solanium and Magic Eden, ask for KYC. Others, like Smithii, don’t.

Pump.fun usually doesn’t require KYC. But, more platforms are starting to ask for it as rules get stricter.

What happens if a project fails after launching through a Solana launchpad?

If a project fails, the outcome varies. Some platforms try to protect investors, but most don’t offer direct help.

It’s key to do your homework before investing. Always remember that launchpad investments are risky. Only put in what you can afford to lose.

Are KYC requirements common on Solana launchpads?

KYC rules change from one platform to another. Places like Solanium and StarLaunch ask for KYC to follow rules and keep things safe. But, some spots like Smithii let you skip it, and Pump.fun usually doesn’t ask for it at all. As things grow, more places will ask for KYC.

What happens if a project fails after launching through a Solana launchpad?

If a project fails, it depends on the launchpad’s rules and how it failed. Some places try to protect investors by checking projects and keeping money safe. But, most don’t pay back if a project fails. So, always do your homework before investing.

Conclusion: Navigating the Solana Launchpad Ecosystem

Solana launchpads are a big step forward in funding and building communities on blockchain. They have low costs, fast speeds, and a growing world. This makes them great for both creators and investors.

When picking a Solana launchpad, think about what you need, how much risk you can take, and what you want to achieve. Creators should look at who they want to reach, what they need technically, and how they’ll help after launch. Investors should check on safety, how good the project is, and what they need to join.

Doing your homework is key. The best ones in this world are those who really get to know the platforms and projects. They make smart choices, not just because of excitement or fear of missing out.

Whether you’re starting a new DeFi project or want to invest in early ones, Solana launchpads are a great way to get into blockchain in 2024 and later.

Ready to Explore Solana Launchpads?

Begin by looking at the top platforms we’ve talked about. Find the one that fits your needs best.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe