ARK Investment boosted their Aurora Innovation holdings by 425,933 shares. They invested $2.29 million in this speculative play. This move signals confidence in Aurora’s potential.

I’ve been following aur stock as it navigates autonomous vehicle development. Aurora differs from auryn resources or gold mining stocks. It operates in a field where regulations are still developing.

Aurora’s approach is methodical, with over 4 million test miles for their “Aurora Driver” platform. They’re building a solid foundation, not just chasing headlines. Regulations are becoming clearer, catching the eye of institutional investors.

Aurora’s strategy targets trucks, cars, and commercial vehicles. This diversification wasn’t obvious at first. Now, it seems like a smart risk management move.

Key Takeaways

- ARK Investment increased Aurora Innovation holdings by 425,933 shares worth $2.29 million

- Aurora’s “Aurora Driver” platform has accumulated over 4 million test miles

- Regulatory reforms are accelerating toward clarity in the autonomous vehicle sector

- The platform targets trucks, cars, and commercial vehicles for diversified market approach

- Institutional investor confidence suggests potential that retail investors may be overlooking

Overview of Aurora Innovation and AUR Stock

Aurora Innovation takes a deliberate, engineering-focused approach to autonomous driving technology. They’re building something substantial, not chasing headlines with flashy demonstrations. Their methodical strategy becomes clear when examining their actual developments.

The company has a comprehensive vision targeting multiple vehicle types simultaneously. This approach sets them apart from competitors focusing on single market segments.

Company Background

Industry veterans founded Aurora Innovation with a focus on sustainable autonomous vehicle development. Their Aurora Driver platform represents years of focused engineering work. It’s a versatile technology platform adaptable across different vehicle categories.

Aurora’s target market spans trucks, passenger cars, and commercial vehicles. This diversification strategy addresses varying adoption timelines and regulatory challenges across transportation sectors.

Aurora Innovation has logged over 4 million test miles in various conditions. They’ve tackled complex urban environments, challenging weather, and real-world scenarios often overlooked by competitors.

Recent Developments

Aurora’s acquisition of Uber’s Advanced Technologies Group (ATG) was a game-changer. It brought proven engineering capabilities and real-world passenger operation experience. This move added immediate credibility to Aurora’s development efforts.

The ATG integration provided valuable intellectual property and testing data. Access to real-world performance data has significantly accelerated Aurora’s development timeline.

Recent partnerships with major automotive manufacturers validate Aurora’s approach. These commitments suggest the industry views Aurora’s technology as production-ready.

Market Position

Aurora Innovation is classified as a “Tier 1” pure-play autonomous vehicle leader. This puts them alongside companies like Pony.ai in technological capability and market potential. Aurora’s platform approach gives them a unique competitive edge.

The AUR stock reflects Aurora’s tangible progress toward commercialization. Their adaptable Aurora Driver platform provides multiple revenue streams and reduces market risk.

Aurora’s practical approach to market entry sets them apart. They focus on specific use cases where autonomous technology offers immediate value. This strategy positions AUR stock as a more stable investment in the sector.

Key Factors Driving AUR Stock Growth

Aurora’s stock momentum stems from three pillars reshaping the autonomous vehicle landscape. These factors create a compound effect, accelerating the company’s trajectory. Their impact is reshaping the industry’s future.

The regulatory environment has become more favorable. Recent reforms have eliminated many bureaucratic hurdles slowing down testing and deployment. Extended crash reporting deadlines and narrowed criteria for non-fatal incidents reduce administrative burden.

These changes impact innovation speed and cost efficiency. Companies can now focus more resources on development rather than compliance paperwork. This shift allows for faster progress in autonomous technology.

Technological Advancements

Aurora’s technological breakthroughs are fundamental shifts in autonomous systems. Their approach to sensor fusion and machine learning has reached impressive maturity levels. The company’s progress in real-world problem solving is particularly compelling.

Their systems now handle complex scenarios like construction zones and emergency vehicles. Aurora’s recent demonstrations show reaction times consistently outperforming human drivers. This technology creates safer, more efficient transportation systems.

“We’re not just building self-driving cars; we’re creating the foundation for an entirely new transportation ecosystem.”

Partnerships and Collaborations

Aurora has strategically aligned with established players for manufacturing and distribution. Their collaboration with major trucking companies addresses immediate market needs. Long-haul trucking faces severe driver shortages, creating challenges that autonomous solutions can solve.

The partnership strategy reduces capital requirements. By working with established manufacturers, Aurora can scale faster without massive infrastructure investments. These alliances provide valuable real-world testing environments.

Market Demand for Autonomous Vehicles

Market demand for autonomous vehicles is reaching an inflection point. The trucking industry alone represents a $700 billion market opportunity. Driver shortages have created urgent operational challenges in commercial transportation.

Companies actively seek solutions to maintain service levels while reducing labor costs. Expanded exemptions under AVEP have removed regulatory barriers, creating clearer pathways to market.

Consumer acceptance has shifted dramatically. Recent surveys show over 60% of Americans would consider using autonomous ride-sharing services. Insurance companies now offer favorable rates for autonomous vehicle operators.

Aurora Innovation has positioned itself at the center of this transformation. The convergence of technological readiness, partnerships, and market demand explains AUR stock’s continued investor attention.

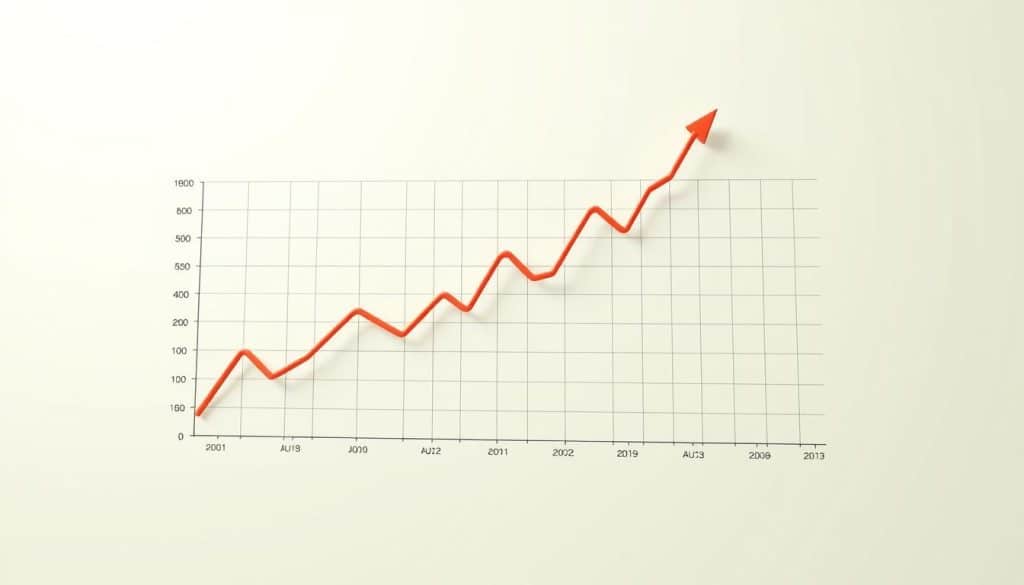

Graphical Analysis of AUR Stock Performance

Aurora Innovation stock’s price movements tell a story about technology investment cycles. The patterns show how AUR stock navigates autonomous vehicle development challenges. Aurora’s performance differs from gold mining equities that follow commodity cycles.

Aurora’s journey shows distinct phases in its stock graph. Each price shift matches milestones in autonomous driving technology. This creates a unique investment profile compared to companies like Auryn Resources.

Historical Price Trends

Aurora’s price data shows typical volatility of emerging tech stocks. Early trading had extreme swings as investors struggled with valuation models.

Three phases emerge in the historical trends. The IPO period brought speculation. The middle phase showed consolidation as reality set in.

The recent phase shows mature institutional interest. AUR stock patterns differ from traditional sectors like gold mining equities.

Recent Surge in Stock Value

Aurora’s latest stock surge links to concrete business developments, not mere speculation. This shift shows a change in how the market views the company’s future.

Key drivers include increased institutional investment and regulatory progress. ARK Investment’s larger position signals growing confidence in Aurora’s technology platform.

This surge reflects real partnership announcements and testing milestones. AUR stock is separating from broader tech selloffs, showing recognition of Aurora’s maturing business.

Comparative Analysis with Competitors

Comparing Aurora to competitors reveals interesting market dynamics. The autonomous vehicle sector shows varied approaches to valuation and risk assessment.

| Company | Market Cap | Revenue Status | Volatility Rating | Institutional Ownership |

|---|---|---|---|---|

| Aurora Innovation | $4.2B | Pre-revenue | High | 68% |

| Pony.ai | $8.0B | Limited revenue | Very High | 45% |

| Luminar Technologies | $2.8B | Growing revenue | High | 72% |

| Waymo (Alphabet) | $2.1T parent | Testing phase | Low | 85% |

The data shows Aurora in the middle of the autonomous vehicle landscape. Aurora navigates uncertain tech markets, unlike Auryn Resources in established mining sectors.

Aurora’s high institutional ownership suggests growing confidence among professional investors. This contrasts with the speculative nature often seen in gold mining stocks during booms.

Statistical Insights into AUR Stock

Aurora’s stock performance data reveals a company transitioning towards commercial viability. This shift creates fascinating valuation dynamics, separating Aurora from typical speculative tech plays. The numbers tell a more nuanced story than headline price movements suggest.

ARK Investment’s recent increase of 425,933 shares, valued at approximately $2.29 million, represents significant institutional confidence in Aurora’s trajectory. This calculated move comes from one of the most respected technology-focused investment firms.

Performance Metrics

Aurora’s metrics show genuine business evolution rather than speculative hype. Its transition from R&D to pre-commercial deployment creates unique valuation dynamics. These differ significantly from traditional investment patterns.

Unlike junior gold miners or precious metals exploration companies, Aurora’s metrics focus on technological milestones. Test miles completed, regulatory approvals obtained, and partnership agreements signed are now fundamental indicators.

Institutional investors now evaluate Aurora using real business metrics. This marks a shift from earlier speculation-driven investment patterns in the autonomous vehicle sector.

Volume Trends

Aurora’s volume trends reveal sustained institutional buying. This differs from the retail-driven spikes that characterized earlier movements in the stock. The pattern suggests a mature investment approach focused on long-term technological development.

The sustained institutional interest indicates confidence in Aurora’s business model and execution capabilities. Volume patterns show consistent accumulation rather than boom-bust cycles typical of early-stage technology investments.

Investor Sentiment Analysis

Investor sentiment has evolved from pure speculation to something approaching fundamental analysis. This shift represents a maturation in how the market views autonomous vehicle technology investments.

Investors now focus on regulatory timeline certainty and government policy support for autonomous vehicle deployment. Earlier sentiment was driven largely by technology demonstrations and prototype announcements.

The broader regulatory environment has significantly influenced sentiment evolution. Government policies becoming more supportive of autonomous vehicle deployment have created optimism about timeline certainty.

Future Predictions for AUR Stock

Aurora Innovation’s stock future depends on several interconnected factors. Balancing technological optimism with commercial realities is crucial. I’m cautiously optimistic based on current market trends.

Analyst forecasts now focus more on business fundamentals rather than speculation. This represents a maturation of the investment community’s approach to evaluating autonomous vehicle companies.

Analyst Forecasts

Analysts believe Aurora is set for significant growth once commercial deployment begins. Timing remains the key variable in these predictions.

Most forecasts suggest that Aurora’s platform approach offers multiple revenue generation paths. This flexibility gives Aurora an advantage over many competitors.

The first commercial deployment partnership announcement could trigger a significant stock revaluation. This milestone often leads to major changes in tech company valuations.

Economic Factors Influencing Predictions

Recent economic shifts are shaping predictions in new ways. The move towards electrification creates favorable conditions for autonomous vehicle adoption.

Supply chain management for autonomous vehicle components has become crucial. Companies that excel in this area will have a competitive advantage.

The regulatory environment is becoming more favorable for autonomous vehicles. New reforms and updates are expected to accelerate sector-wide gains.

Aurora could benefit greatly if the Autonomous Vehicle Acceleration Act passes. This legislation would speed up regulatory updates, potentially fast-tracking Aurora’s market entry.

Long-term Growth Potential

The long-term growth potential for autonomous vehicles is substantial. This technology could transform transportation as fundamentally as the internet changed communication.

Aurora’s comprehensive approach to autonomous driving is particularly promising. They’re creating an integrated platform that addresses multiple aspects of the technology.

The commercial deployment timeline is crucial for realizing this potential. Successful real-world operations could significantly boost investor confidence and drive stock appreciation.

FAQs About Aurora Innovation and AUR Stock

Investors often struggle with key concepts that set Aurora apart from traditional automotive companies. These concepts are crucial for making informed investment decisions in autonomous vehicle technology.

Let’s explore the most common questions about AUR stock. These reflect broader market confusion about investing in self-driving car companies.

What is Aurora Innovation’s business model?

Aurora is a Tier 1 pure-play autonomous vehicle leader with a platform-based approach. They create the “brain” that makes vehicles drive themselves.

Their technology serves as the intelligence layer for various vehicle types. Aurora develops software and sensor systems that can be installed in different cars and trucks.

This strategy means Aurora doesn’t need huge factories. They focus on perfecting technology that other companies will license and use.

Aurora’s business model is fundamentally different from traditional automotive companies—they’re not manufacturing vehicles but developing the software and sensor integration that makes vehicles autonomous.

Aurora’s revenue comes from licensing fees and software subscriptions. They expect ongoing income from every vehicle using their system once it’s commercially available.

How does AUR Stock compare to other stocks in the market?

AUR stock doesn’t fit into typical investment categories. It’s not a standard growth stock or a value play like some gold mining equities.

Aurora is a pre-revenue tech company with big potential but high risks. This requires different evaluation methods than established companies.

| Investment Type | Revenue Status | Risk Level | Potential Upside | Time Horizon |

|---|---|---|---|---|

| AUR Stock | Pre-revenue | High | Very High | 3-7 years |

| Traditional Tech | Established | Medium | Moderate | 1-3 years |

| Gold Mining Equities | Cyclical | Medium-High | High | Variable |

| Autonomous Competitors | Mixed | High | High | 2-5 years |

When comparing Aurora to rivals, I look at technical achievements and partnerships. Aurora’s approach shows promise, especially in commercial trucking partnerships.

AUR stock is more like a tech bet than a typical investment. Its success depends on whether self-driving cars become widely used.

What are the risks associated with investing in AUR Stock?

The risks are serious and shouldn’t be ignored. Many investors treat self-driving car stocks as sure winners without understanding the challenges.

Regulatory delays are the biggest immediate risk. Government approval for self-driving cars is unpredictable and can take years longer than expected.

Technical challenges remain despite Aurora’s progress. Self-driving in complex cities still has unsolved problems. Weather, unexpected road situations, and human drivers create ongoing hurdles.

Competition from well-funded rivals is another big threat. Companies like Waymo and Tesla invest billions in similar technology.

Market adoption timing is uncertain. Even with perfect tech, consumers and businesses might take longer to accept self-driving vehicles.

Unlike gold mining equities, AUR stock depends entirely on self-driving car market success. It’s not diversified across different economic conditions.

Consider Aurora as a small part of a diverse portfolio. Investors who understand these risks may benefit if the technology succeeds.

Treat this investment as a calculated risk, not a core holding. Careful risk management is crucial with pre-revenue tech companies in new markets.

Investment Tools and Resources for AUR Stock

Aurora Innovation’s investment landscape requires specialized tools beyond conventional metrics. Its pre-revenue technology model needs a different analytical approach. Standard financial screeners fall short when analyzing emerging autonomous vehicle companies.

Investment landscape analysis positions Aurora in Tier 1 with other pure-play autonomous vehicle leaders. Institutional investors like ARK provide validation through increased holdings. This signals sophisticated analysis beyond traditional metrics.

Stock Screeners for AUR

Effective stock screeners for Aurora focus on technology-specific filters rather than traditional financial metrics. The most useful screeners can filter for companies with specific characteristics. These include patent portfolios and regulatory approval progress.

Here are the key screening criteria I recommend:

- Patent portfolio size and quality

- Test mile accumulation data

- Regulatory approval progress tracking

- Institutional ownership changes

- Technology partnership announcements

Traditional screeners focusing on P/E ratios and dividend yields won’t provide much value here. Aurora’s value lies in intellectual property and technological advancement.

Investment Analysis Platforms

Platforms specializing in emerging technology companies provide better insights than general financial tools. Those tracking institutional holdings and insider trading patterns offer the most valuable data.

ARK Investment’s increased position shows that sophisticated investors see value in Aurora. This institutional validation carries more weight than traditional financial metrics for pre-revenue tech companies.

Recommended platform features include:

- Institutional ownership tracking

- Patent analysis capabilities

- Technology milestone monitoring

- Regulatory filing alerts

- Competitor comparison tools

These platforms help distinguish Aurora from sectors where geological surveys and resource estimates drive valuations.

Financial News Sources

Aurora’s financial news requires a mix of automotive industry publications, technology news sites, and regulatory tracking services. Valuable information often comes from industry conferences and regulatory filings rather than traditional financial news.

Focus on sources that understand the technical and regulatory complexities of autonomous vehicles. Aurora coverage requires deep technical knowledge, unlike commodity-driven stories for other industries.

The most valuable information often comes from industry conferences and regulatory filings rather than traditional financial news.

Essential news source categories include:

- Automotive industry trade publications

- Technology innovation news sites

- Regulatory tracking services

- Patent filing databases

- Industry conference proceedings

Aurora’s story unfolds through technological breakthroughs and regulatory milestones. This differs from resource discoveries that dominate coverage in other industries.

Essential Guide for New Investors in AUR Stock

AUR stock requires understanding unique concepts before investing. It’s different from traditional investments. Aurora Innovation operates in a new field, making standard valuation methods ineffective.

The autonomous vehicle sector needs patience and risk tolerance. Aurora’s value depends on future potential and technological advances. This differs from established companies with steady revenues.

Understanding Stock Market Basics

Aurora requires different analysis than traditional investments. Speculative stocks don’t follow standard ratios or yield dividends. They rely on market adoption, regulatory approval, and tech superiority.

Aurora’s lack of revenue sets it apart from mature companies. Its stock price reflects future potential, not current earnings. This causes extreme price swings that challenge investors.

Timing is crucial with speculative tech investments. Aurora’s stock can move 20% in a day on news. Understanding this volatility helps set realistic investment expectations.

Steps to Invest in AUR Stock

Buying Aurora shares is easy through major brokers. However, deciding to invest needs careful thought about risk and timeline.

Start with a small position, about 1-2% of your portfolio. This lets you join potential gains without risking too much capital.

Research Aurora’s partnerships, test results, and regulatory progress before buying. Set clear entry and exit plans based on your goals. Avoid reacting emotionally to daily price changes.

Portfolio Diversification Strategies

Diversification is key when investing in speculative tech companies. Treat autonomous vehicle stocks as a small part of your tech allocation.

Balance AUR stock with other investments. Gold mining companies offer stability during market uncertainty. Gold resource stocks can protect against inflation.

Don’t make Aurora your only autonomous vehicle investment. Spread risk across multiple companies, sectors, and asset types. This strategy allows for tech growth while maintaining portfolio stability.

Evidence Supporting AUR Stock Value

Real-world testing results provide strong evidence for AUR stock’s potential. Aurora Innovation backs its market position with measurable achievements. The company’s approach differs from gold mining equities, where value often depends on commodity prices.

Multiple data points support Aurora’s investment thesis. Evidence spans market research, technical performance, and real-world deployment success. This foundation makes AUR stock attractive for investors seeking exposure to autonomous vehicle technology.

Market Growth Projections

Industry reports highlight autonomous technology as a transformative market opportunity. Research firms project the market will reach $2.8 trillion by 2030. This growth trajectory exceeds traditional automotive sectors and emerging markets like auryn resources.

Commercial trucking shows strong fundamentals. Long-haul trucking represents a $700 billion market where autonomous tech can deliver cost savings. Aurora’s focus on this segment positions them ahead of competitors targeting complex urban environments.

Early adopters will capture disproportionate value. Companies establishing technical leadership now will benefit from network effects and data advantages.

Technical Performance Data

Aurora’s 4 million test miles provide substantial real-world validation of their technology. This testing volume exceeds many competitors and offers crucial data for algorithm refinement. Each mile generates valuable information about edge cases and system performance.

Uber’s Advanced Technologies Group acquisition brought proven engineering talent and intellectual property. This team had demonstrated autonomous vehicle capabilities in urban environments. Their integration accelerated Aurora’s development timeline significantly.

Technical benchmarks show Aurora’s system achieving industry-leading safety metrics. Their disengagement rates compare favorably to other autonomous vehicle developers. These performance indicators directly correlate with commercial viability.

Commercial Deployment Success

Aurora’s partnership strategy demonstrates practical market validation. Major logistics companies have committed to pilot programs using Aurora’s technology. These partnerships provide revenue streams while validating commercial applications.

Early deployment results show measurable efficiency improvements in freight operations. Fuel savings, reduced driver costs, and improved route optimization deliver quantifiable benefits. These success stories attract additional commercial partners and validate the business model.

Aurora’s staged approach to market entry reduces risk while building credibility. Starting with controlled environments shows operational discipline. This methodology appeals to investors seeking sustainable growth rather than speculative gains.

Sources for Tracking AUR Stock and Market News

Tracking Aurora Innovation’s stock needs specialized sources that understand autonomous technology development. This approach differs from following conventional investments like junior gold miners. Effective monitoring requires sources that grasp both technology and regulatory aspects.

Recent regulatory changes create positive conditions for Aurora’s development. Extended crash reporting deadlines and expanded exemptions under the Automated Vehicle Exemption Program are key factors. These updates often get overlooked in general automotive coverage.

Financial News Websites

Specialized technology publications offer better insights than mainstream financial media. They focus on automotive technology and emerging transportation trends. These sources provide more relevant coverage than those covering precious metals exploration or traditional manufacturing.

The best sources track regulatory changes alongside financial performance. These developments can significantly impact Aurora’s costs and timeline. Traditional stock analysis might miss these crucial factors.

Stock Analysis Reports

Reports from firms specializing in emerging technology companies provide valuable insights. These specialized reports understand the unique metrics that matter for autonomous vehicle companies. They differ from reports on gold exploration companies that focus on resource reserves.

The most useful reports combine technical assessment with financial analysis. They track safety validation progress, commercial deployment timelines, and competitive positioning. Look for analysts who demonstrate actual knowledge of the autonomous vehicle business model.

Investor Community Forums

Investor forums can offer real-time information, but you must filter out noise. The most valuable discussions happen in forums focused specifically on autonomous vehicle investments. Forums dedicated to emerging technology investments often provide better insights.

Contributors share regulatory updates, partnership announcements, and technical developments. These factors can impact stock performance. Develop a diverse information ecosystem covering technology, regulations, competition, and financial performance.

Competitive Analysis of AUR Stock in the Tech Sector

Aurora’s stock evaluation requires a look at its diverse competitors. The autonomous vehicle landscape is complex. It’s not like comparing gold mining companies or other established industries.

Aurora operates in a multi-layered competitive environment. They face pressure from various sectors. These include sensor makers, chip companies, and tech giants.

The dynamics are similar to gold resource stocks during market uncertainty. Investors need to understand different segments within this emerging industry.

Major Competitors in Autonomous Technology

Aurora is in the “Tier 1” category alongside Pony.ai. Pony.ai recently achieved an $8 billion valuation after its IPO. This reflects their technical abilities and strategic partnerships.

Sensor companies like Luminar Technologies and Aeva Technologies offer different competition. They focus on hardware for autonomous driving. These firms could partner directly with vehicle makers, bypassing platforms like Aurora.

Tech giants also compete. NVIDIA provides computing platforms for autonomous systems. Mobileye, owned by Intel, has experience in driver assistance systems.

This competition differs from traditional sectors. Autonomous vehicle companies compete on multiple fronts at once. This is unlike gold mining, where competition is mainly about resource quality and costs.

Market Share Comparison

Measuring market share in autonomous vehicles is challenging. Most applications are still pre-commercial. Traditional metrics don’t apply well yet.

However, some data points help show competitive positioning:

| Company | Test Miles Completed | Commercial Partnerships | Market Valuation | Primary Focus |

|---|---|---|---|---|

| Aurora Innovation | 4+ million miles | FedEx, Uber Freight | $13 billion (peak) | Trucking platform |

| Pony.ai | 3+ million miles | Toyota, Hyundai | $8+ billion | Robotaxi services |

| Luminar Technologies | N/A (sensor focus) | Volvo, Mercedes | $3 billion | LiDAR hardware |

| Mobileye | Commercial deployment | BMW, Ford, others | $50+ billion | ADAS systems |

Aurora’s 4 million test miles show they’re building strong advantages. Their trucking focus offers a clearer path to market. This beats robotaxi competitors facing more regulations.

Their platform strategy could create valuable network effects. This is similar to how successful gold mining companies benefit from economies of scale.

Recent Mergers and Acquisitions Impacting Stocks

M&A activity reveals a lot about competitive dynamics. Aurora’s purchase of Uber’s ATG in 2020 was a game-changer. It brought in 1,200 employees and valuable tech.

This move eliminated a competitor and sped up Aurora’s timeline. It gave them a 12-18 month advantage in development.

Other important M&A activities include:

- Ford’s acquisition of Argo AI assets after shutting down the autonomous vehicle unit

- Amazon’s investment in Aurora through multiple funding rounds

- General Motors’ continued investment in Cruise despite setbacks

- Intel’s acquisition of Mobileye and subsequent spin-off strategy

These moves show companies are pooling talent and tech. They aim to speed up development. This pattern is similar to other emerging sectors, but with higher stakes.

M&A is shifting from pure tech buys to strategic partnerships. Success needs more than just great tech. It requires strong ties with car makers, logistics firms, and regulators.

The focus is now on building ecosystems, not just tech. Aurora’s platform and trucking focus could give them an edge. This strategy may help them capture more value.

Unlike gold resource stocks, autonomous vehicles may have a winner-take-most outcome. The market might consolidate around a few key platforms. This makes competitive positioning crucial for long-term success.

Conclusion: Is AUR Stock a Smart Investment?

Aurora Innovation’s journey in autonomous vehicles is at a fascinating crossroads. The company blends cutting-edge technology with favorable regulatory momentum.

Recap of Key Points

Aurora’s 4 million test miles and Tier 1 status show real technical progress. Recent regulatory reforms create a more favorable environment for autonomous vehicles.

ARK’s increased holdings signal institutional confidence in the sector. AUR stock offers a unique opportunity compared to traditional investments.

The biggest challenge remains the uncertain timeline for full commercialization.

Final Thoughts on Future Prospects

Technical progress, regulatory support, and market demand create a compelling setup. Recent regulatory changes represent fundamental shifts toward supporting autonomous deployment.

Competition is fierce, but Aurora’s strategic positioning gives them a fighting chance. This market could potentially produce a single dominant player.

Recommendations for Investors

Consider starting small with AUR stock, around 1-2% of your portfolio. This investment isn’t suitable for those seeking predictable returns.

Keep an eye on regulatory developments that could speed up timelines. Aurora’s technical capability and favorable regulatory environment make it an intriguing high-risk, high-reward option.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Toncoin

Toncoin  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe